I've been working in Vancouver this week. Reading the article in today's Vancouver Sun about Vancouver condo prices and how high they can go, got me thinking.

I've been working in Vancouver this week. Reading the article in today's Vancouver Sun about Vancouver condo prices and how high they can go, got me thinking.Wednesday, January 31, 2007

Vancouver Condo Prices

I've been working in Vancouver this week. Reading the article in today's Vancouver Sun about Vancouver condo prices and how high they can go, got me thinking.

I've been working in Vancouver this week. Reading the article in today's Vancouver Sun about Vancouver condo prices and how high they can go, got me thinking.Saturday, January 27, 2007

Average SFH Prices - non-CPI and CPI Adjusted

Single Family Home average selling prices were taken from the Victoria Real Estate Board website. Here - http://www.vreb.org/history/GRAA2006.pdf and here - http://www.vreb.org/history/YE782006.pdf

As numerical data wasn't given for the years prior to 1978, I looked very closely at the historical graph to get values for 1967 through 1977.

The following graph is based on average SFH selling prices, not taking CPI inflation into consideration. My graph should look the same as the one from VREB, with color cues from VHB and OHB.

The graph nicely shows that, over time, RE always goes up. Of course, during the down turns, or RE market crashes, that may not appear so believable.

The graph nicely shows that, over time, RE always goes up. Of course, during the down turns, or RE market crashes, that may not appear so believable.

I had CPI inflation values until 1975. For 1967 through 1974, I used CPI values that were averaged from 1975 to 2006. Taking CPI inflation into consideration magnifies the price declines during the early 1970s and the mid-1980s. It appears that from 2002 till the present, we are definitely above the norm for average SFH prices.

Based on these graphs, where are SFH prices going? Have we reached another peak, with a down turn coming to bring us into line with historical norms? Or will prices continue to rise indefinitely?

Unfortunately, as I was manipulating my graphs to make them somewhat more eye-catching, I closed Excel without saving my data. I had assumed I had previously saved it. I had not. Thus, I will, in the future, go through a spell of deja vu as I recreate my spreadsheet. At that point, I'll have data to prove the graphs.

Wednesday, January 24, 2007

The American, er, Victorian, Dream

Ok, this is not something new. I think that a lot of people, myself included, who did not get into the market 5 years ago, have been feeling this for some time. The subject in the article is quite typical of many people. Her situation is compounded by being a single mother. She would have to travel back in time to 1991 in order to buy a house for the mortgage that she qualifies for (assuming she has a 25% downpayment). Last I checked, time travel had not yet been perfected.

I've lamented to my father, who still lives on the prairies, numerous times over the real estate prices in Victoria. His response is that I should suck it up because I live in the California of Canada. I guess that this is true. If someone moaned and complained about real estate prices in Malibu, California, would we feel sorry for them? I doubt it. I wouldn't. Move somewhere else!

I think that the "move somewhere else" philosophy may soon start applying to Victoria, Vancouver, etc. If current real estate prices are here to stay, and increases in wages do not follow, then us renters will have to re-evaluate our life priorities. Which is more important to us - home ownership or living in Victoria? As in the Demographia survey, there certainly are less expensive, more affordable, places to live! Regina, Winnipeg, Quebec City! In those cities, a single mother, or father, or any single income family can afford a home.

And there are places closer to Victoria than Regina where affordability is better - Campbell River, Ladysmith, even Duncan. A new 1600 sq. ft. townhome in Duncan can be bought for just over $220k. A steal of a price compared to Victoria.

It looks like if the current prices in Victoria or here to stay, we'll be renting for some time, or moving elsewhere! How about you?

Monday, January 22, 2007

Victoria's Affordability

Saturday, January 20, 2007

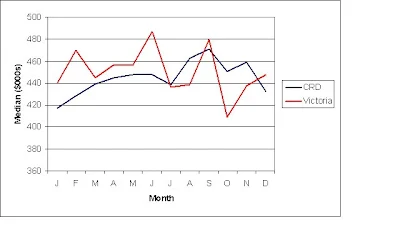

January 20 Week Ending Stats

The first graph looks at listings of 2 bedroom condos, 3 bedroom townhomes, and 3 bedroom single family homes. I hoped that by following the trend of listings inventory, and with a little help from the supply and demand principle, it would be possible to make a guestimate on the direction of prices. These curves are very similar to the stats given by the Victoria Real Estate Board. High inventory during the summer and fall, with a decrease during November and December. It appears that we may have hit the inventory low, with numbers now starting to rebound over the past couple weeks.

The first graph looks at listings of 2 bedroom condos, 3 bedroom townhomes, and 3 bedroom single family homes. I hoped that by following the trend of listings inventory, and with a little help from the supply and demand principle, it would be possible to make a guestimate on the direction of prices. These curves are very similar to the stats given by the Victoria Real Estate Board. High inventory during the summer and fall, with a decrease during November and December. It appears that we may have hit the inventory low, with numbers now starting to rebound over the past couple weeks. I was also interested in the breakdown of listings of all single family homes in different price ranges. Above is the current percentage of SFH in the noted prices ranges (in $000). There's not much below $300000. There's lots above $700000!

I was also interested in the breakdown of listings of all single family homes in different price ranges. Above is the current percentage of SFH in the noted prices ranges (in $000). There's not much below $300000. There's lots above $700000!

It will be interesting to follow the numbers this spring and then heading into summer. If Victoria follows the pattern of a number of American cities, we should see continued higher than norm listings. It would only make sense that prices should drop, but I seem to always have been incorrect in previous predictions about the local real estate market. This Prairieboy is still attempting to understand the west coast home market!

Are there any predictions out there?Where will listings numbers go?

How about prices? Up? Down?

Buy now, or wait?

Friday, January 19, 2007

Construction craziness

As I drove home, I was left wondering "Where in the world are the people who need to buy these homes gonna come from?"

I know, Alberta, Vancouver, Asia, Europe, etc. But really? That many to Victoria?

Another thing is that there continues to be a lot of homes in Langford and Colwood that languish on MLS for what seems to be an enternity. Condos even more so. Citiwalk condos in Langford has had "Only 5 2-bed, 2-bath Units Left!" for months and months already. I think they better up the antee from their last promotion of a $1500 gift card for Mayfair Mall. Based on the number of condo sales in December and the number of condo listings currently in Langford, there is 11 months of supply. To sell a condo today, you'd really have to raise the bar.

I've been compiling numbers for Victoria from MLS for a little over 6 months. I'll be revealing them tomorrow. Stay tuned!

Thursday, January 18, 2007

Encouraged to wait...

Wouldn't it just make sense that prices should start falling in Victoria, due to the supply and demand argument? They appear to be dropping in Vancouver already, as witnessed through VHB.

Maybe I am the greedy one in hoping that prices decrease in order for me to get a piece of the action.

Monday, January 15, 2007

Average income = average house???

The house I had bought was around $90 / square foot!

Fast forward to today. My wife and I would really love to purchase a home. We're tired of listening to our neighbours rap music, hearing mice scurry within the walls, and feeling like we can't have friends over for dinner because our space is a little tight. And we're not in a bad place! We live close to Cook Street Village and pay over $1100 / month.

We plan to use the maximum we can from the "Home Buyers Option". Our downpayment for a home should be acceptable. The problem lies in the future monthly payments. We're planning for children in the next year or two, so our income will be reduced to one and a bit. A mortgage for a townhouse in this city, with our downpayment, would be around $300 - 350k. Mortgage payments would be nearly $2000 a month. I'm puzzled as to how we could afford this with our situation. I don't think we can.

If you're a first time homeowner, perhaps with a young family, how did you do it?

Do you sleep at night with a mortgage that is larger that the GDP of some countries?

Am I going to have to either: a) get a 2nd job, b) sell my baseball card collection, c) win the lottery, or d) all of the above?

Maybe this is our new reality. Thanks.

Saturday, January 13, 2007

Welcome!

Lots of discussion in the future will be great!

Enjoy!