I've had a lot going on, so it's come down to prioritizing. The blog has slipped on the importance list. It's nice though how it carries on without me. Please do feel free to continue to use the blog as a forum even as my postings have become less frequent.

Further on the person note, a couple months ago I ranted on how perhaps it was time to get out of the rental market. Well, it looks like we've decided to give our rental suite another year. We'll just make room and organize a little better for when this little person arrives this fall. In a year's time, we'll re-evaluate again.

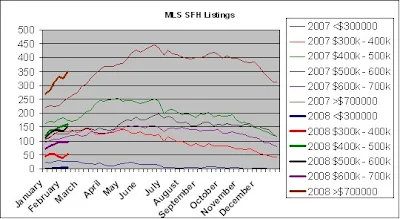

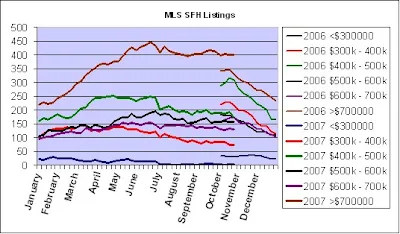

I have still been keep inventory stats. Listings continue to increase, not quite at the pace as experienced in May though. I have only 6 more condos listed on MLS.ca today than there were on May 31. There are 4 fewer townhomes. There are 96 more SFH. In comparison to last year, there are 282 more SFH listings.

According to this realtor's website, there are right now 4848 active listings in Greater Victoria. This is 230 more than on May 31. The numbers don't make sense. None-the-less, inventory is still increasing.

I got a good laugh out of a realtor's comments on today's market condition. This is a direct quote from an email -

"So I thought "what would I say today about the Victoria Real Estate Market if someone asked"?

My comments would be that we have a balanced market where we are indeed selling at the rate of 1 SALE to 5 LISTINGS or 20% success ratio!!! In Vancouver and Lower mainland the ratio is 1 Sale to 10 LISTINGS or 10%!!

So Victoria is still quite active and prices are staple - a balanced market!"

Go figure!