Of course, June sales numbers won't be out until tomorrow at the earliest. So here are my SFH sales estimates. Average price should be close to $600000, probably between $590k and $600k. June 2009 average will be higher than June 2008. Median looks to be around $535000. Total SFH sold in June will be slightly lower than May. I'd estimate that total VREB sales for June will also be a little lower than May, but higher than June 2008. It's a wide range, but sales should be between 750 and 850 for June. Inventory has also dropped - last night I recorded 4126 properties for sale, as per this realtor's website. This morning they show 3911 properties for sale. Inventory is significantly lower this June than June 2008.

We've put an offer on a house. They countered, we countered, they countered, and we couldn't agree on a price. We were disappointed, but in hindsight, I firmly believe it was a blessing in disguise. The search continues....

Showing posts with label Prices. Show all posts

Showing posts with label Prices. Show all posts

Wednesday, July 1, 2009

Saturday, October 27, 2007

October 27 Week Ending Stats

The number of listings on MLS.ca is down this Saturday in comparison to last Saturday. There are 22 fewer SFH, 11 fewer townhomes, and 17 fewer condos.

I'm gonna go out on a limb this week. I'm calling Victoria's average SFH sale price in September ($584193) as the peak average price for Victoria for the next couple years. With winter coming, what's going on in the U.S. and Alberta, and rising mortgage rates, I think we've hit the top. April 2008 will be the first time since March 2007 that Victoria has a year over year decrease in average SFH price. Average monthly prices for the summer of 2008 will be lower than the summer of 2007.

Of course, I am 100% amateur, and have nothing riding on this prediction (aside from house prices moving further from my affordability level if I'm wrong). Put only as much stock into this as you want.

As I write, I have friends bidding on a house in Victoria. As strongly as I feel, I try not to influence their decision. If I am wrong, and they hold back because of me, thus falling further behind the rising prices, I'm partially responsible. I don't want to be. Everyone needs to be responsible for their own decisions. If you are comfortable with the numbers, go ahead and seal the deal. I think that good things will come to those who wait.

Update: My friends bidding on the house did not get it. Reason being - after offers were supposed to be in, the selling realtor continued to show the house, and tell new interested parties what the current high offer was. It's pretty easy to place the highest offer when you know what second place will be. The ethics of some in the realtor profession continue to disappoint me.

I'm gonna go out on a limb this week. I'm calling Victoria's average SFH sale price in September ($584193) as the peak average price for Victoria for the next couple years. With winter coming, what's going on in the U.S. and Alberta, and rising mortgage rates, I think we've hit the top. April 2008 will be the first time since March 2007 that Victoria has a year over year decrease in average SFH price. Average monthly prices for the summer of 2008 will be lower than the summer of 2007.

Of course, I am 100% amateur, and have nothing riding on this prediction (aside from house prices moving further from my affordability level if I'm wrong). Put only as much stock into this as you want.

As I write, I have friends bidding on a house in Victoria. As strongly as I feel, I try not to influence their decision. If I am wrong, and they hold back because of me, thus falling further behind the rising prices, I'm partially responsible. I don't want to be. Everyone needs to be responsible for their own decisions. If you are comfortable with the numbers, go ahead and seal the deal. I think that good things will come to those who wait.

Update: My friends bidding on the house did not get it. Reason being - after offers were supposed to be in, the selling realtor continued to show the house, and tell new interested parties what the current high offer was. It's pretty easy to place the highest offer when you know what second place will be. The ethics of some in the realtor profession continue to disappoint me.

Tuesday, August 7, 2007

Focus on SFH Sales

As I did for condos and townhomes, I've made a few graphs for SFH sales and median prices for Greater Victoria, Victoria, Langford and Saanich.

The number of sales of single family homes in Greater Victoria is higher this year than 2005 and 2006. Median sale price is increasing, and has not been negative year-over-year since 2005.

The City of Victoria has had high sales numbers the past couple of months. The median sale price is down from earlier this year. June's median sale price was negative year-over-year.

Langford has had an average number of SFH sales thus far this year. The median sale price is increasing.

Saanich home sales have been on a tear the past two months. Median sale price is consistently increasing at around 10% year-over-year.

All regions' year-over-year median price increases (%) have risen from late 2006 and early 2007. It's difficult to determine a definitive pattern due to our small market. There have been very few year-over-year monthly decreases since 2005.

I plan to have graphs for other municipalities in the future. Hopefully this provides a little food-for-thought.

The number of sales of single family homes in Greater Victoria is higher this year than 2005 and 2006. Median sale price is increasing, and has not been negative year-over-year since 2005.

The City of Victoria has had high sales numbers the past couple of months. The median sale price is down from earlier this year. June's median sale price was negative year-over-year.

Langford has had an average number of SFH sales thus far this year. The median sale price is increasing.

Saanich home sales have been on a tear the past two months. Median sale price is consistently increasing at around 10% year-over-year.

All regions' year-over-year median price increases (%) have risen from late 2006 and early 2007. It's difficult to determine a definitive pattern due to our small market. There have been very few year-over-year monthly decreases since 2005.

I plan to have graphs for other municipalities in the future. Hopefully this provides a little food-for-thought.

Sunday, July 29, 2007

Condo Prices at the Railyards

June 19th I mentioned how a price review was underway for phase 4 of the Railyards development, titled "The Gateway." The price review has been completed, and prices have gone up. Increases are between $0 and $30000. This increase is a pretty big surprise to me, because of the 62 units available, only 28 have sold thus far. I believe the building is nearing completion. I'm sure that building costs have increased, justifying the price increase, in their minds. But I can't see them becoming more competitive and selling more units in today's condo market through upping the prices. Someone responsible for the increases needs to give their head a shake!

June 19th I mentioned how a price review was underway for phase 4 of the Railyards development, titled "The Gateway." The price review has been completed, and prices have gone up. Increases are between $0 and $30000. This increase is a pretty big surprise to me, because of the 62 units available, only 28 have sold thus far. I believe the building is nearing completion. I'm sure that building costs have increased, justifying the price increase, in their minds. But I can't see them becoming more competitive and selling more units in today's condo market through upping the prices. Someone responsible for the increases needs to give their head a shake!The Julia condo development has been completed. There was a lot of back patting in Saturday's TC for this accomplishment. It's a good thing they are 50% sold already! Get ready for the fire sale! Did anyone get a chance to attend the grand opening?

I think it would be fun to be in the market for a new condo these days. I'd definitely be low-balling the new developments. I wonder what sort of deals could be found!

Sunday, June 17, 2007

Deception!

I'm outraged! The latest ad for Reflections in Langford is absolute and total deception! The ad states that you can now buy a 2 bedroom condo valued at $334900 for zero money down, thus giving you a $995 monthly payment for the first twelve months (whatever that means!). First of all, zero money down is a poor financial decision (we are now NO different than what went on in the U.S.). Secondly, $995 a month, yeah right. Put into a mortgage calculator the $334900 purchase price, 40 year amortization, 5.99% interest rate, what do you get - $1823.23 a month! What the...!!! I wonder, is it Peter Gaby or the developers sensing a serious downturn that are willing to pay for half your mortgage for the first year!

I'm outraged! The latest ad for Reflections in Langford is absolute and total deception! The ad states that you can now buy a 2 bedroom condo valued at $334900 for zero money down, thus giving you a $995 monthly payment for the first twelve months (whatever that means!). First of all, zero money down is a poor financial decision (we are now NO different than what went on in the U.S.). Secondly, $995 a month, yeah right. Put into a mortgage calculator the $334900 purchase price, 40 year amortization, 5.99% interest rate, what do you get - $1823.23 a month! What the...!!! I wonder, is it Peter Gaby or the developers sensing a serious downturn that are willing to pay for half your mortgage for the first year!People, don't do it! It's all lies!

Sorry, I've gotta take some deep breaths here. If Gaby and/or the developer wanted to maintain a stitch of integrity, they'd simply lower the prices and present the real purchase numbers. However, they know that to present that same monthly mortgage payment, even with the 40 year amortization, the price of that particular condo would have to be $183000. Wow, that's almost reasonable!

Thursday, May 31, 2007

CMHC "Housing Now" Report for April

CMHC released today the "Housing Now" report for Victoria for April. It can be found here.

I wish that CMHC would release these reports sooner. Today's report is for April, while tomorrow is June. April is old news already.

The big news is the large number of starts in April, combining with the current high level of construction in Greater Victoria. There are currently 3010 housing units under construction, a 45% rise over April of 2006. However, year to date, there is a 17% decrease on the number of units absorbed. Looks like overbuilding to me.

CMHC reports the average price of single detached dwellings from VREB statistics, however, they remove waterfront, acreage, duplex, and manufactured homes. This provides quite a different number for the average price. CMHC's average SFH price for April was $524600. VREB's average SFH price was $568710. That's a difference of $44100. Any ideas why CMHC removes those homes from the equation?

A quick chart comparing CMHC to VREB numbers for SFH average selling price.

I wish that CMHC would release these reports sooner. Today's report is for April, while tomorrow is June. April is old news already.

The big news is the large number of starts in April, combining with the current high level of construction in Greater Victoria. There are currently 3010 housing units under construction, a 45% rise over April of 2006. However, year to date, there is a 17% decrease on the number of units absorbed. Looks like overbuilding to me.

CMHC reports the average price of single detached dwellings from VREB statistics, however, they remove waterfront, acreage, duplex, and manufactured homes. This provides quite a different number for the average price. CMHC's average SFH price for April was $524600. VREB's average SFH price was $568710. That's a difference of $44100. Any ideas why CMHC removes those homes from the equation?

A quick chart comparing CMHC to VREB numbers for SFH average selling price.

Saturday, May 12, 2007

May 12 Week Ending Stats

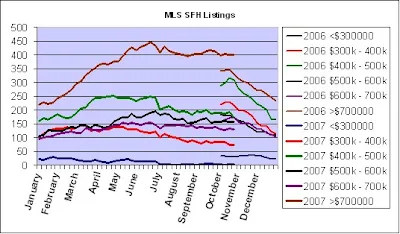

Inventory of single family homes with a listing price of more than $500000 continues to rise much faster than SFH with a listing price of less than $500000. There are 34 more MLS listings for SFH with an asking price of over $500k this week, with 17 of those having a listing price of more than $700k. There are only 2 more SFH listings this week with an asking price of less than $500k.

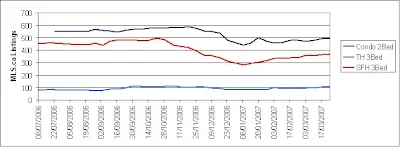

The number of listings for three bedroom SFH and townhomes continues to rise. Listings for two bedroom condos appears to be all over the map. There has been a large decrease in the last two weeks.

I'm suspecting that this month is shaping up to have a decrease in average price for SFH. The reason being that inventory of high priced homes is building rapidly, while lower priced home inventory is not. Through this, I'm lead to think that homes with sub-$500k prices are selling in higher quantities than home with the higher prices. I could be wrong - I usually am.

The number of listings for three bedroom SFH and townhomes continues to rise. Listings for two bedroom condos appears to be all over the map. There has been a large decrease in the last two weeks.

I'm suspecting that this month is shaping up to have a decrease in average price for SFH. The reason being that inventory of high priced homes is building rapidly, while lower priced home inventory is not. Through this, I'm lead to think that homes with sub-$500k prices are selling in higher quantities than home with the higher prices. I could be wrong - I usually am.

Sunday, May 6, 2007

Million Dollar Market

In yesterday's post, I commented on how according to estimated numbers, it appears that the housing market is still a seller's market. There were a number of comments on how homes in certain neighbourhoods are sitting for a long time. These homes are high-end homes, with asking prices over $1 million. So, I thought it would be appropriate to calculate the market we are in for million dollar plus homes.

From yesterday's numbers, let's assume that there were 1653 SFH listed in April. I've been tracking the number of SFH listed on MLS for over $1 million for a couple weeks. Yesterday, we had 169 SFH listed with asking prices of $1 million or higher. This represents 15.5% of all SFH listings. 15.5% of April's 1653 SFH listings is 256 listings. According to VREB, 28 SFH sold for over $1000000 in April. This gives us 9.1 months of inventory for SFH priced over $1000000.That is definitely a buyer's market!

Attention! Everyone in the market for buying a $1 million dollar home - name your price to the seller, because their home is going to be sitting for a long time! Everyone selling a million dollar plus home, you'd better be sharpening your pencil if you truly want to sell your house!

And yes, the asking price for this home is $1.15 million. There are almost 5 acres, but seriously! Get real!

From yesterday's numbers, let's assume that there were 1653 SFH listed in April. I've been tracking the number of SFH listed on MLS for over $1 million for a couple weeks. Yesterday, we had 169 SFH listed with asking prices of $1 million or higher. This represents 15.5% of all SFH listings. 15.5% of April's 1653 SFH listings is 256 listings. According to VREB, 28 SFH sold for over $1000000 in April. This gives us 9.1 months of inventory for SFH priced over $1000000.That is definitely a buyer's market!

Attention! Everyone in the market for buying a $1 million dollar home - name your price to the seller, because their home is going to be sitting for a long time! Everyone selling a million dollar plus home, you'd better be sharpening your pencil if you truly want to sell your house!

And yes, the asking price for this home is $1.15 million. There are almost 5 acres, but seriously! Get real!

Saturday, May 5, 2007

May 5 Week Ending Stats

63.2% of all single family homes listed today for Greater Victoria on MLS.ca have an asking price of $500000 or higher. 14.4% of SFH are listed for $400000 or less.

The number of listings for SFH priced above $500k continues to rise faster than SFH listed under $500k.

I'm trying to wrap my head around some stats based on April's numbers and today's SFH "asking price" dollar range percentages. The median selling price for SFH in April was $489000. Therefore, more that 50% of SFH sold for less than $500k, less than 50% of SFH sold for more than $500k. Based on the number of listings on MLS today, 36.8% of SFH have an asking price of <= $500k, 63.2% of SFH have an asking price of >=$500k.

Some of the following numbers are estimates, but I think the general idea will come across. Based on my calculations, approximately 50% of the listings for Greater Victoria on MLS are SFH. According to VREB, there were 3305 active listings in April. Let's assume then that 50% of the active listings were SFH, 1653.

Using today's MLS percentage numbers, if there were 1653 SFH listed in April, 36.8% will have been listed for under $500k. This gives us 608 SFH under $500k. 63.2% will have been listed for over $500k. This gives us 1045.

467 SFH were sold in April. The median was $489000. More than 233.5 SFH sold for less than $500k, less than 233.5 SFH sold for more than $500k. For simplicity, I'll use those numbers. SFH under $500k, 233.5 sales, 608 listings, this equals 2.6 months of inventory. SFH over $500k, 233.5 sales, 1045 listings, this equals 4.5 months of inventory.

What does this all point to? Price compression? Sputtering upper-end? A seller's market? Perhaps a number of things. A quick search on the web regarding months-of-inventory and 6.0 came up as the MOI switching point between seller's and buyer's markets. This leads me to believe that based on April's numbers, Victoria's Real Estate market is still a seller's market, with homes priced under $500k very much favouring sellers. Homes prices over $500k are moving closer to a buyer's market, but not yet there.

Spring is a busy selling season. The MOI should move closer to a buyer's market over the summer. However, for a major shift, we will need significantly more listings and / or fewer sales.

The number of listings for SFH priced above $500k continues to rise faster than SFH listed under $500k.

I'm trying to wrap my head around some stats based on April's numbers and today's SFH "asking price" dollar range percentages. The median selling price for SFH in April was $489000. Therefore, more that 50% of SFH sold for less than $500k, less than 50% of SFH sold for more than $500k. Based on the number of listings on MLS today, 36.8% of SFH have an asking price of <= $500k, 63.2% of SFH have an asking price of >=$500k.

Some of the following numbers are estimates, but I think the general idea will come across. Based on my calculations, approximately 50% of the listings for Greater Victoria on MLS are SFH. According to VREB, there were 3305 active listings in April. Let's assume then that 50% of the active listings were SFH, 1653.

Using today's MLS percentage numbers, if there were 1653 SFH listed in April, 36.8% will have been listed for under $500k. This gives us 608 SFH under $500k. 63.2% will have been listed for over $500k. This gives us 1045.

467 SFH were sold in April. The median was $489000. More than 233.5 SFH sold for less than $500k, less than 233.5 SFH sold for more than $500k. For simplicity, I'll use those numbers. SFH under $500k, 233.5 sales, 608 listings, this equals 2.6 months of inventory. SFH over $500k, 233.5 sales, 1045 listings, this equals 4.5 months of inventory.

What does this all point to? Price compression? Sputtering upper-end? A seller's market? Perhaps a number of things. A quick search on the web regarding months-of-inventory and 6.0 came up as the MOI switching point between seller's and buyer's markets. This leads me to believe that based on April's numbers, Victoria's Real Estate market is still a seller's market, with homes priced under $500k very much favouring sellers. Homes prices over $500k are moving closer to a buyer's market, but not yet there.

Spring is a busy selling season. The MOI should move closer to a buyer's market over the summer. However, for a major shift, we will need significantly more listings and / or fewer sales.

Saturday, April 28, 2007

April 28 Week Ending Stats

Once again, month end is nearly upon us. From an outsider's viewpoint, it appears that there has been a nice inventory increase in April. Based on MLS.ca listings, March 31 had 1021 single family homes listed. Today there are 1085 SFH listed. The largest jump came this last week. There are 51 more SFH listed this Saturday than last Saturday. Regarding all MLS.ca listings for Greater Victoria, there are 185 more property listings today than there were on March 31.

There were MLS listing increases for SFH in each price range this past week. Most noteworthy, there was an astounding 50% increase in SFH listed for under $300000! There are now a whopping 15 homes listed under $300k! Nine of those 15 are in Sooke. Great! Inventory of high-end homes continues to climb. 377 SFH are priced over $700k, with 165 of those being over $1 million.

As a percentage of all SFH listed on MLS, homes with an asking price of between $500k and $600k saw the largest increase this past week. There are 18 more listings on MLS in that range. A one percent increase for that price range was the result. 62.7% of all SFH listed on MLS have an asking price of $500k or higher.

How will April's VREB stats look? My best guesstimate - sales between 750 and 800, total MLS listings around 3300. Prices - SFH average up slightly ($550k), condo average below $300k, and townhome average $380k - $400k. That's my best shot in the dark. I hope I'm wrong on the prices. What's yours?

There were MLS listing increases for SFH in each price range this past week. Most noteworthy, there was an astounding 50% increase in SFH listed for under $300000! There are now a whopping 15 homes listed under $300k! Nine of those 15 are in Sooke. Great! Inventory of high-end homes continues to climb. 377 SFH are priced over $700k, with 165 of those being over $1 million.

As a percentage of all SFH listed on MLS, homes with an asking price of between $500k and $600k saw the largest increase this past week. There are 18 more listings on MLS in that range. A one percent increase for that price range was the result. 62.7% of all SFH listed on MLS have an asking price of $500k or higher.

How will April's VREB stats look? My best guesstimate - sales between 750 and 800, total MLS listings around 3300. Prices - SFH average up slightly ($550k), condo average below $300k, and townhome average $380k - $400k. That's my best shot in the dark. I hope I'm wrong on the prices. What's yours?

Monday, April 23, 2007

Discounted Condos

We are seeing developers reducing their condo prices to make the sale. Two examples I've noticed in the past week.

1) Tuscany Village - For months, their full page ad in the Times Colonist stated how units have been held at June 2006 prices. This past week, in celebration of their on-site show suite, prices have been "temporarily" reduced. We'll see how "temporary" those prices are! Did anyone check out what the discounts were like?

2) Reflections in Langford - The website for Reflections has prices starting at $299,900. For months, the lowest priced unit on MLS for the development was $289,900. Today, there is a unit on MLS for $279,900. That's a $20,000 discount. Aren't you glad you didn't buy when it was first released! Won't you be glad in the future when you look back to your decision today to wait a little longer!

Any other discounted condos out there? I'm betting we'll see discounts at Carey Hill Walk, McConnell Place, the Juliet, and others. Just you wait...

1) Tuscany Village - For months, their full page ad in the Times Colonist stated how units have been held at June 2006 prices. This past week, in celebration of their on-site show suite, prices have been "temporarily" reduced. We'll see how "temporary" those prices are! Did anyone check out what the discounts were like?

2) Reflections in Langford - The website for Reflections has prices starting at $299,900. For months, the lowest priced unit on MLS for the development was $289,900. Today, there is a unit on MLS for $279,900. That's a $20,000 discount. Aren't you glad you didn't buy when it was first released! Won't you be glad in the future when you look back to your decision today to wait a little longer!

Any other discounted condos out there? I'm betting we'll see discounts at Carey Hill Walk, McConnell Place, the Juliet, and others. Just you wait...

Saturday, April 21, 2007

April 21 Week Ending Stats

The number of homes listed on MLS for under $300000 declined again this week. Perform a quick search on MLS for SFH under $300k and you'll find only 10. Number of homes in the $300k - $400k range has been steady since January. There has be an gradual increase of homes available for between $400k - $500k since the low point in early January. Inventory of homes between $500k and $700k has been quite flat this year. For the first time since January 6, there are fewer homes listed this week than last with a price tag higher than $700k. However, the number of million dollar plus homes increased this past week.

Two bedroom condo listings jumped by 57 this week. I haven't investigated the reason behind this. I'd assume it was the release of a condo development to general MLS listings. Three bed SFH and townhome listings were flat.

I'm definitely noticing more front lawn realtor signs in my neighbourhood. Most of them are condo listings. I think that if you are serious about selling your home these days, you have to set your place apart from the rest. Either you need a smokin' price, or there has to be excellent value for the buyers' money. Unless you start with a steal of a deal, the days of flipping are over.

Two bedroom condo listings jumped by 57 this week. I haven't investigated the reason behind this. I'd assume it was the release of a condo development to general MLS listings. Three bed SFH and townhome listings were flat.

I'm definitely noticing more front lawn realtor signs in my neighbourhood. Most of them are condo listings. I think that if you are serious about selling your home these days, you have to set your place apart from the rest. Either you need a smokin' price, or there has to be excellent value for the buyers' money. Unless you start with a steal of a deal, the days of flipping are over.

Saturday, April 14, 2007

April 14 Week Ending Stats

Based upon listings available for viewing on MLS, I'm seeing two trends take place. The first trend is a continued decline in affordability of SFH. The second trend is an increase in inventory of entry level 2 bedroom condos and 3 bedroom townhomes.

Today, there are only 11 SFH listings on MLS for under $300k. That is 1% of all SFH listings for Greater Victoria. I look at $300k as the ceiling for affordability for an average family earning an average income. With a 25% down payment, the average family would have a mortgage of $225k on a $300k SFH. 25 year amortization and a 5.25% interest rate would yield a monthly payment of $1341. Adding in taxes and utilities, that family would likely be looking at monthly obligations of between $1600 and $1700. Considering these numbers to be 32% of that family's gross income would require $60k to $64k annual income. There is next to nothing available in SFH for the average family in Victoria today!

Listings of SFH with an asking price of greater than $700k continues to increase. There was an increase in SFH listings for all price ranges except SFH less than $300k and SFH between $500k and $600k. There are 157 SFH with an asking price of $1 million or higher available for your MLS viewing pleasure. Enjoy!

Regarding the second trend I'm seeing, there are 39 listings of two bedroom condos for under $200k this week. That is the same quantity as last week. Of note, that is the most listings since I started recording in August of 2006.

There are 22 listings for townhomes under $300k this week. There were 27 sub $300k townhomes on October 14, 2006. Last September and October, Victoria had record levels of active listings. Today, we do not have the number of active listings as we did last September / October, however, we have nearly as many townhomes available for under $300k.

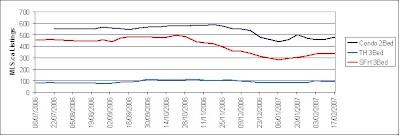

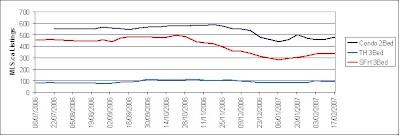

The following chart is simply an update of housing categories I'm personally interested in.

I believe that what we are seeing continues to point to the next year or two being very interesting for the Victoria housing market. It really looks like we are teetering on the edge. Hey, if you're looking for something to do this weekend, check out the following video. It's been mentioned a number of times in the comments. It's the roller coaster ride for the U.S. housing market.

Today, there are only 11 SFH listings on MLS for under $300k. That is 1% of all SFH listings for Greater Victoria. I look at $300k as the ceiling for affordability for an average family earning an average income. With a 25% down payment, the average family would have a mortgage of $225k on a $300k SFH. 25 year amortization and a 5.25% interest rate would yield a monthly payment of $1341. Adding in taxes and utilities, that family would likely be looking at monthly obligations of between $1600 and $1700. Considering these numbers to be 32% of that family's gross income would require $60k to $64k annual income. There is next to nothing available in SFH for the average family in Victoria today!

Listings of SFH with an asking price of greater than $700k continues to increase. There was an increase in SFH listings for all price ranges except SFH less than $300k and SFH between $500k and $600k. There are 157 SFH with an asking price of $1 million or higher available for your MLS viewing pleasure. Enjoy!

Regarding the second trend I'm seeing, there are 39 listings of two bedroom condos for under $200k this week. That is the same quantity as last week. Of note, that is the most listings since I started recording in August of 2006.

There are 22 listings for townhomes under $300k this week. There were 27 sub $300k townhomes on October 14, 2006. Last September and October, Victoria had record levels of active listings. Today, we do not have the number of active listings as we did last September / October, however, we have nearly as many townhomes available for under $300k.

The following chart is simply an update of housing categories I'm personally interested in.

I believe that what we are seeing continues to point to the next year or two being very interesting for the Victoria housing market. It really looks like we are teetering on the edge. Hey, if you're looking for something to do this weekend, check out the following video. It's been mentioned a number of times in the comments. It's the roller coaster ride for the U.S. housing market.

Saturday, April 7, 2007

April 7 Week Ending Stats

There are a some interesting items from this weeks' gleaning of the listings on MLS. First, the number of three bedroom townhomes that are listed is at the highest number (124) since I started recording last July 8. Second, listings of two bedroom condos took a dive this past week. Condo listings appear to be nearly flat so far this year, which surprises me. However, listings of two bedroom condos with an asking price of less than $200000 is at the highest number (39) since I started recording. Admittedly, a lot of those condos are fractional ownership.

Thirdly, availability of SFH with an asking price of less than $300000 is at the lowest level since probably forever. There are only 13 homes listed for less than $300000. As a percentage, this is 1.28% of all SFH MLS listings. Flip side, the number of homes listed with an asking price of higher than $700000 continues to grow. There are currently 367 homes listed in that price range. There are 149 SFH with an asking price of $1 million or higher!

All SFH price ranges saw a decrease in listings this past week, except for the SFH with an asking price higher than $700000. Unfortunately, I can't say whether that is due to expiries, sales, or removal of listings. Is the market at a standoff between sellers and buyers? Or do the number of sales closely match the number of new listings? It would certainly be nice to have the inside scoop on what is happening. My apologies that I cannot provide such information.

62.6% of SFH listings have an asking price of $500000 or higher. Ouch.

Thirdly, availability of SFH with an asking price of less than $300000 is at the lowest level since probably forever. There are only 13 homes listed for less than $300000. As a percentage, this is 1.28% of all SFH MLS listings. Flip side, the number of homes listed with an asking price of higher than $700000 continues to grow. There are currently 367 homes listed in that price range. There are 149 SFH with an asking price of $1 million or higher!

All SFH price ranges saw a decrease in listings this past week, except for the SFH with an asking price higher than $700000. Unfortunately, I can't say whether that is due to expiries, sales, or removal of listings. Is the market at a standoff between sellers and buyers? Or do the number of sales closely match the number of new listings? It would certainly be nice to have the inside scoop on what is happening. My apologies that I cannot provide such information.

62.6% of SFH listings have an asking price of $500000 or higher. Ouch.

Saturday, March 31, 2007

March 31 Week Ending Stats

Great discussions this week. I'm sorry I wasn't a part of it. The wireless internet at my hotel in Campbell River this week was sketchy at the best of times. Fortunately, I think my schedule for the near future keeps me at home. As great as it is to get 123+ comments on a post, I'll try to post more frequently, thus keeping you from having so much scrolling. Also, I've appreciated the emails with suggestions on future topics.

Ahhh, Campbell River. The final frontier. Well, not quite. On first impression, it appeared to me that there were a lot of for sale signs on the Old Island Highway. Not knowing the area though, that may be the norm. Quick check on MLS, and for $200 / square foot, you get ocean front property. Not bad, but still a little too much. Really, how many salaries in Campbell River can afford a $600000 home? Any up island readers out there? What are you seeing in your cities?

There was a definate up-tick of listings for SFH on MLS this week. There are 41 more SFH listed this Saturday than last Saturday. There are 125 more SFH listed today than there was four weeks ago. As we all know, this week's VREB report will show a continued increase in active listings. Of course, not knowing the number of sales, I can't estimate very accurately the number of active listings for the month. A rough guess, I'd say we're in the ballpark of around 3150 active listings for March. This would be a 27% increase in listings over last year.

Inventory of homes in the $400k - $500k and the >$700k continues to rise, while the other price ranges are closer to flat. I don't quite understand why the $400k - $500k range is increasing faster than the other sub-$700k ranges. Perhaps it is because a lot of the newer homes being built in the 'burbs are in that price range. Perhaps it is because homes below $400k and above $500k are selling, but the $400k - $500k range has low value for your money. Below $400k are "starter" homes, while above $500k, you get a lot more for your money than the $400k - $500k range.

Percentage of homes in each price range was flat for the week.

This will be an interesting week with March stats coming out. My prediction for average prices - SFH and townhomes down from February, condos up slightly. As useless a stat as it is, the YOY for SFH for March should be fun. March 2006 SFH average was $557k. If this March is down, maybe to $520k, that a 7% YOY decrease. If we do see a down March, with negative YOY numbers, do you think the MSM will report that? I doubt it - they'll spin it some way, some how.

Ahhh, Campbell River. The final frontier. Well, not quite. On first impression, it appeared to me that there were a lot of for sale signs on the Old Island Highway. Not knowing the area though, that may be the norm. Quick check on MLS, and for $200 / square foot, you get ocean front property. Not bad, but still a little too much. Really, how many salaries in Campbell River can afford a $600000 home? Any up island readers out there? What are you seeing in your cities?

There was a definate up-tick of listings for SFH on MLS this week. There are 41 more SFH listed this Saturday than last Saturday. There are 125 more SFH listed today than there was four weeks ago. As we all know, this week's VREB report will show a continued increase in active listings. Of course, not knowing the number of sales, I can't estimate very accurately the number of active listings for the month. A rough guess, I'd say we're in the ballpark of around 3150 active listings for March. This would be a 27% increase in listings over last year.

Inventory of homes in the $400k - $500k and the >$700k continues to rise, while the other price ranges are closer to flat. I don't quite understand why the $400k - $500k range is increasing faster than the other sub-$700k ranges. Perhaps it is because a lot of the newer homes being built in the 'burbs are in that price range. Perhaps it is because homes below $400k and above $500k are selling, but the $400k - $500k range has low value for your money. Below $400k are "starter" homes, while above $500k, you get a lot more for your money than the $400k - $500k range.

Percentage of homes in each price range was flat for the week.

This will be an interesting week with March stats coming out. My prediction for average prices - SFH and townhomes down from February, condos up slightly. As useless a stat as it is, the YOY for SFH for March should be fun. March 2006 SFH average was $557k. If this March is down, maybe to $520k, that a 7% YOY decrease. If we do see a down March, with negative YOY numbers, do you think the MSM will report that? I doubt it - they'll spin it some way, some how.

Saturday, March 24, 2007

March 24 Week Ending Stats

Single family home inventory continues to rise in Greater Victoria. There are 115 more SFH listed on MLS today than there were 1 month ago. High-end homes are really hitting the ball out of the park. There are nearly as many SFH with an asking price greater than $700k listed today as there were last October, which was when active listings in Victoria hit an all time high. People are either asking more for their homes, or they are trying to get rid of their expensive homes while they can. Expect this inventory level to rise even higher. I'd hate to be in a position where I had to unload a $700k+ home and there were 340 others to choose from - with that number increasing!

As a whole, there continues to be fewer sub-$400k homes to choose from. I believe that it's been discussed at HHV how these homes are moving, but high-enders are not. This may change, as you are starting to get a lot more home for $450k-$500k than you are for $350k-$400k.

It's interesting to see a pie chart again...

Finally, 2 bed condo and 3 bed SFH inventory has a ways to go before it reaches the levels of last fall. 3 bed townhome inventory is about as boring as watching your dog run away for 3 days on the prairies.

As a whole, there continues to be fewer sub-$400k homes to choose from. I believe that it's been discussed at HHV how these homes are moving, but high-enders are not. This may change, as you are starting to get a lot more home for $450k-$500k than you are for $350k-$400k.

It's interesting to see a pie chart again...

Finally, 2 bed condo and 3 bed SFH inventory has a ways to go before it reaches the levels of last fall. 3 bed townhome inventory is about as boring as watching your dog run away for 3 days on the prairies.

Monday, March 12, 2007

How out-to-lunch are our prices?

First, kudos to House Hunt Victoria on his blog. I've really enjoyed reading it thus far, and there's been some great commentary on his topics. Nice work! My entry today may be of interest to him and others who are debating between renting and buying.

I've been doing some thinking and some number crunching. My young family will need a larger living dwelling in the next year or two. The question is, and will be, should we buy or continue to rent? We've been, and will continue, to save all our extra pennies in an attempt to maximize our down payment, should that be our decision. Part of the reasoning behind my starting this blog was to educate myself as much as possible about today's housing market, and thus make a wise decision.

Using Craigslist and Renting.ca, I pulled together a spreadsheet of rental asking prices for 3+ bedroom homes, and then calculated the average monthly asking price. I know that the number I came up with is not 100% accurate, as there will be duplicate ads between the web sites. Also, in going through the ads quickly, I'm sure I pulled in the occasional number from Parksville or Nanaimo or wherever other than Victoria. But I do think that the average I got should be pretty close.

Average rental asking price for 3, 4, or 5 bedroom home = $1693 / month.

What is the average rental price for a 2 bedroom suite? We pay over $1100 / month. Our friends are paying between $800 - $1050. However, they've all been in their current locations for 2+ years. I think it is fair to say that conservatively, the average rent for a nice 2 bedroom suite is around $1000 / month.

Consider this - a large home, 3+ bedrooms upstairs, 2 bedroom suite down. If both were rented at the average asking price, total monthly rent income = $1693 + $1000 = $2693.

Homes that meet the 3+ beds up, 2 bed suite down, criteria can be bought today for $500000 or less. This home is not in Oak Bay, probably not in Victoria proper, but it is in Langford or Colwood, maybe even Saanich (MLS does have a 3 bed up / 2 bed down home in Maplewood for $409900). Put 10% down as the down payment. Including CMHC fees, mortgage comes in at approximately $459000. At today's interest rate, say 5%, 25 year amortization, monthly mortgage payment is $2683.

Hey, if you live upstairs, rent the downstairs suite, your mortgage payment is then $1683. Less than the average rent for a 3+ bed home!

Ok, there's property taxes, maybe $300/month, utilities $200 / month, misc repairs, I don't know. Yes, it is more expensive to buy. But, if you take into consideration the fact that equity is being built, is it really any more expensive? The first month's payment knocks the principal down by $771. That's $771 in equity, so long as the value of the house does not decrease.

Try this. $2683 (mortgage payment) + $500 (taxes and utilities) = $3183.

$3183 (monthly cost of purchased home) - $771 (equity) - $1000 (2 bed suite) = $1412.

In buying a home, $1412 / month (initially) is down the drain. Renting the 3+ bed home, it's $1693 / month.

I know that this comparison is not perfect, and I do believe that house prices are too high for current rents (especially small homes, townhomes, and condos). What I'm asking is whether the cost of renting is really that much less than buying a comparable home with suite? Is it me or just our home prices that are totally out-to-lunch?

I've been doing some thinking and some number crunching. My young family will need a larger living dwelling in the next year or two. The question is, and will be, should we buy or continue to rent? We've been, and will continue, to save all our extra pennies in an attempt to maximize our down payment, should that be our decision. Part of the reasoning behind my starting this blog was to educate myself as much as possible about today's housing market, and thus make a wise decision.

Using Craigslist and Renting.ca, I pulled together a spreadsheet of rental asking prices for 3+ bedroom homes, and then calculated the average monthly asking price. I know that the number I came up with is not 100% accurate, as there will be duplicate ads between the web sites. Also, in going through the ads quickly, I'm sure I pulled in the occasional number from Parksville or Nanaimo or wherever other than Victoria. But I do think that the average I got should be pretty close.

Average rental asking price for 3, 4, or 5 bedroom home = $1693 / month.

What is the average rental price for a 2 bedroom suite? We pay over $1100 / month. Our friends are paying between $800 - $1050. However, they've all been in their current locations for 2+ years. I think it is fair to say that conservatively, the average rent for a nice 2 bedroom suite is around $1000 / month.

Consider this - a large home, 3+ bedrooms upstairs, 2 bedroom suite down. If both were rented at the average asking price, total monthly rent income = $1693 + $1000 = $2693.

Homes that meet the 3+ beds up, 2 bed suite down, criteria can be bought today for $500000 or less. This home is not in Oak Bay, probably not in Victoria proper, but it is in Langford or Colwood, maybe even Saanich (MLS does have a 3 bed up / 2 bed down home in Maplewood for $409900). Put 10% down as the down payment. Including CMHC fees, mortgage comes in at approximately $459000. At today's interest rate, say 5%, 25 year amortization, monthly mortgage payment is $2683.

Hey, if you live upstairs, rent the downstairs suite, your mortgage payment is then $1683. Less than the average rent for a 3+ bed home!

Ok, there's property taxes, maybe $300/month, utilities $200 / month, misc repairs, I don't know. Yes, it is more expensive to buy. But, if you take into consideration the fact that equity is being built, is it really any more expensive? The first month's payment knocks the principal down by $771. That's $771 in equity, so long as the value of the house does not decrease.

Try this. $2683 (mortgage payment) + $500 (taxes and utilities) = $3183.

$3183 (monthly cost of purchased home) - $771 (equity) - $1000 (2 bed suite) = $1412.

In buying a home, $1412 / month (initially) is down the drain. Renting the 3+ bed home, it's $1693 / month.

I know that this comparison is not perfect, and I do believe that house prices are too high for current rents (especially small homes, townhomes, and condos). What I'm asking is whether the cost of renting is really that much less than buying a comparable home with suite? Is it me or just our home prices that are totally out-to-lunch?

Saturday, March 10, 2007

March 10 Week Ending Stats

Listings of single family homes on MLS had a greater increase this week. There are 43 more listings today than last week, 74 more than two weeks ago. The largest increase in listings came in the $300000 - $500000 price range. Listings below $300000 are at the lowest level since I started tracking listings inventory (October '06). There are only 18 SFH listed below $300k. I think that this may be a sign that we are seeing price compression, similar to what they are seeing in Vancouver.

As a percentage, less than 2% of SFH listings are under $300000. 37% of SFH listings are between $300k and $500k. 61% of SFH listings are above $500000. That is an astounding number for a city as ours.

Listings of 2 bedroom condos, 3 bedroom townhomes, and 3 bedroom SFH continue to be quite flat, as they have for the past month.

As a percentage, less than 2% of SFH listings are under $300000. 37% of SFH listings are between $300k and $500k. 61% of SFH listings are above $500000. That is an astounding number for a city as ours.

Listings of 2 bedroom condos, 3 bedroom townhomes, and 3 bedroom SFH continue to be quite flat, as they have for the past month.

Saturday, February 24, 2007

February 24 Week Ending Stats

It was another pretty flat week for MLS.ca inventory for 2 bedroom condos, 3 bedroom townhomes, and 3 bedroom single family homes. Two bed condos and 3 bed townhomes had a small decrease in listings, 3 bed SFH had a minimal increase. I am starting to believe that inventory for 3 bed SFH may not be the best indicator of overall SFH inventory. Victoria has a lot of homes larger than 3 beds. Homes in new developments are almost all larger than 3 bedrooms. I think that 3 bedroom homes are essentially from yester-year. With today's current housing market, a 3 bedroom home often doesn't make sense. A family with 2 or more kids will usually require a larger home (not that there are that many families in this category). Home buyers that need to support their purchase monetarily will look at having a mortgage helper suite. Thus, most new homes are 4 bed, 5 bed, or even larger. Besides, with so much of the home value being in the dirt underneath, you get a lot more bang for your buck with a large home.

Further evidence of 3 bedroom homes not necessarily being a good overall inventory indicator is in the fact that inventory of homes with an asking list price higher than $700000 continues to rise, outpacing lesser priced homes. Inventory of homes less than $700000 is flat, while homes higher than $700k have reached a record percentage of overall SFH listings (since Oct 7, 2006).

Today, there were 865 active SFH home listings on MLS. One month ago, January 27, there were 797 active SFH listings, a difference of 68. There are 28 more active townhome listings, and 25 more condo listings. It is interesting that inventory of home listings is increasing faster than that of condo listings. When new condo developments are released, that's when the inventory of condos gets a shot in the arm. Not much has happened for condo releases over the past month. My question does remain though - why are listings for condo developments like Tuscany Village and The Falls not on MLS??? Having these and other condo projects listed would have a large impact on the inventory of condo listings. Are some developments not listed on MLS to give an impression that the inventory of condos is not as high as it really is? This is for certain - there are a lot more condos for sale than what is listed on MLS!

Further evidence of 3 bedroom homes not necessarily being a good overall inventory indicator is in the fact that inventory of homes with an asking list price higher than $700000 continues to rise, outpacing lesser priced homes. Inventory of homes less than $700000 is flat, while homes higher than $700k have reached a record percentage of overall SFH listings (since Oct 7, 2006).

Today, there were 865 active SFH home listings on MLS. One month ago, January 27, there were 797 active SFH listings, a difference of 68. There are 28 more active townhome listings, and 25 more condo listings. It is interesting that inventory of home listings is increasing faster than that of condo listings. When new condo developments are released, that's when the inventory of condos gets a shot in the arm. Not much has happened for condo releases over the past month. My question does remain though - why are listings for condo developments like Tuscany Village and The Falls not on MLS??? Having these and other condo projects listed would have a large impact on the inventory of condo listings. Are some developments not listed on MLS to give an impression that the inventory of condos is not as high as it really is? This is for certain - there are a lot more condos for sale than what is listed on MLS!

Saturday, February 17, 2007

February 17 Week Ending Stats

According to MLS.ca, listings in Greater Victoria have risen slightly this week over the past couple weeks. Two bedroom condo listings have risen from a low dip two weeks ago. Three bedroom SFH and townhomes have risen minimally this week.

The quantity of single family homes with a listing value higher than $700000 continues to rise. From a low of 221 listings in the first week of 2007, there are now 264 listings for SFH higher than $700k. Number of listings in other price categories have risen to a lesser extent. The smallest rise has been in the $400k - $500k range. There are only 9 more listings in this price range on MLS today than there were the first week of the new year.

As a result, the percentage of SFH listings with a listing price higher than $700k continues to rise, while the percent of SFH listings with a price between $400k and $500k continues to fall.

A question - where could I find daily information on sales activity and new listings for Greater Victoria? I can appreciate the info that Rob Chipman provides daily on his blog, as well as the info on the Nanaimo Real Estate Blog, when it was functioning. Is daily sales info only available to Realtors? Is there a site or source that provides this info to the general public? Will I have to get my Realtor license to gain access to this privileged information?

The quantity of single family homes with a listing value higher than $700000 continues to rise. From a low of 221 listings in the first week of 2007, there are now 264 listings for SFH higher than $700k. Number of listings in other price categories have risen to a lesser extent. The smallest rise has been in the $400k - $500k range. There are only 9 more listings in this price range on MLS today than there were the first week of the new year.

As a result, the percentage of SFH listings with a listing price higher than $700k continues to rise, while the percent of SFH listings with a price between $400k and $500k continues to fall.

A question - where could I find daily information on sales activity and new listings for Greater Victoria? I can appreciate the info that Rob Chipman provides daily on his blog, as well as the info on the Nanaimo Real Estate Blog, when it was functioning. Is daily sales info only available to Realtors? Is there a site or source that provides this info to the general public? Will I have to get my Realtor license to gain access to this privileged information?

Subscribe to:

Comments (Atom)