The Victoria Real Estate Board has released their sales numbers for February. Discussion has started in the comments of the previous post. Please feel free to continue commenting on this post.

In comparison to February 2007, sales are down, prices are up, and listings are up. In comparison to January 2008, sales are up, prices are down, listings are up. The last time that Greater Victoria has seen two consecutive months of single family home price decreases was between June and August 2006. SFH average price has decreased 6% since it's peak in December 2007.

Average condo price has pretty much been horizontal since November 2006.

Average townhome price is off big-time from it's peak in November 2007.

I'd love to provide some graphs, but unfortunately, about 2 weeks ago I had a horrendous case of spyware on my computer and was forced to format my hard drive. I haven't located my copy of Excel as of yet. Once I do, the graphs will be back!

Monday, March 3, 2008

Tuesday, February 26, 2008

Why Not Rent?

Here's a challenge, perhaps a dare. Find me a home to rent. It needs to be in View Royal, Langford, Colwood, Mill Bay, Shawnigan, maybe Cobble Hill. It must have 3 bedrooms up, 3 bedrooms (or 2 bedrooms and den / office) down (down is a suite). They must be separate living spaces. The lower suite must be above ground, with minimum 8 foot ceilings and large windows. The house must have a garage and a decent sized yard. The house must be available to rent April 1st or later.

All this for $2500 a month.

If you can find me this house, I will seriously consider renting it. I don't think it exists. I'd love to be wrong.

All this for $2500 a month.

If you can find me this house, I will seriously consider renting it. I don't think it exists. I'd love to be wrong.

Saturday, February 23, 2008

Why Rent?

I need to vent a little.

Unfortunately, the time has come for my wife and I to find a new rental. Reasons being that she works a couple days a week in Duncan, and we live south end of Victoria, so the commute is long, costly, and I don't really like her driving the Malahat so often (I'm a bit of a worry-wart). Also, we are hoping that in the next year or two, we will require more space, as in another bedroom. And so, we are looking for a 2 bedroom and den or 3 bedroom rental that is west of View Royal.

Rentals of that sort are not easily come by! And the prices! Yikes! Are any of you looking for the same thing these days? Unbelievable!

Three-quarters of available rentals are 1 or 2 bedroom. A 3 bedroom rental will be either an entire house, or the upper portion (there are a few 3 bedroom lower rentals, but I imagine them to be dungeons.) Monthly rent for a 3 bedroom does go as low as $1100 / month, but most are more that $1400 / month, the average probably being around $1800 / month. A lot of those don't meet our location criteria.

I'm just tired of renting. Tired of fighting for parking spots. Tired of our minuscule little kitchen. Tired of living in basements. Tired of trying to find a rental for one month from now because our rental agreement states we must give one month notice, yet 90% of all the rentals available are available immediately. Tired of not putting our roots down anywhere.

You guys had better keep me on the straight and narrow. I'm on the verge of going to the bank to see what we what size of mortgage we may qualify for. I feel like we are getting close to the point where for the sake of personal happiness, we may go against better judgement.

Unfortunately, the time has come for my wife and I to find a new rental. Reasons being that she works a couple days a week in Duncan, and we live south end of Victoria, so the commute is long, costly, and I don't really like her driving the Malahat so often (I'm a bit of a worry-wart). Also, we are hoping that in the next year or two, we will require more space, as in another bedroom. And so, we are looking for a 2 bedroom and den or 3 bedroom rental that is west of View Royal.

Rentals of that sort are not easily come by! And the prices! Yikes! Are any of you looking for the same thing these days? Unbelievable!

Three-quarters of available rentals are 1 or 2 bedroom. A 3 bedroom rental will be either an entire house, or the upper portion (there are a few 3 bedroom lower rentals, but I imagine them to be dungeons.) Monthly rent for a 3 bedroom does go as low as $1100 / month, but most are more that $1400 / month, the average probably being around $1800 / month. A lot of those don't meet our location criteria.

I'm just tired of renting. Tired of fighting for parking spots. Tired of our minuscule little kitchen. Tired of living in basements. Tired of trying to find a rental for one month from now because our rental agreement states we must give one month notice, yet 90% of all the rentals available are available immediately. Tired of not putting our roots down anywhere.

You guys had better keep me on the straight and narrow. I'm on the verge of going to the bank to see what we what size of mortgage we may qualify for. I feel like we are getting close to the point where for the sake of personal happiness, we may go against better judgement.

Sunday, February 17, 2008

Deception Part 2

Remember June last year? I ranted over the deceptive scheme being used to sell the Reflections development in Langford. Advertised was a purchase plan for a $335k condo with zero down for $995 per month. Not even in the small print did the ad say that your payments would double after one year.

Well, correct me if I'm wrong, but it looks like Peter Gaby is up to his deceptive ways again this year. This time the development is The Aspen in View Royal. He's advertising a 3 bedroom condo (also 1 bedroom and 2 bedrooms for less) for $1034 per month, with 10% down, 40 year amortization, and a discounted variable rate of 5.25%. At least, the ad does mention that the scheme is "cash back to offset payments over 12 months".

The least expensive 3 bedroom condo in that development has an asking price of $409900. After putting 10% down, your mortgage would be $368910. 40 year amortization, 5.25% rate, gives you a monthly payment of $1826.40.

This year, I'm not as floored over this scheme as I was last year. Truthfully, I'm not surprised. I guess I'm getting jaded.

Well, correct me if I'm wrong, but it looks like Peter Gaby is up to his deceptive ways again this year. This time the development is The Aspen in View Royal. He's advertising a 3 bedroom condo (also 1 bedroom and 2 bedrooms for less) for $1034 per month, with 10% down, 40 year amortization, and a discounted variable rate of 5.25%. At least, the ad does mention that the scheme is "cash back to offset payments over 12 months".

The least expensive 3 bedroom condo in that development has an asking price of $409900. After putting 10% down, your mortgage would be $368910. 40 year amortization, 5.25% rate, gives you a monthly payment of $1826.40.

This year, I'm not as floored over this scheme as I was last year. Truthfully, I'm not surprised. I guess I'm getting jaded.

Saturday, February 9, 2008

Bold Advertising

I thought today's Tuscany Village ad in the TC was quite bold, considering that RE in Victoria always only goes up. I wonder how choked other developer's are with this ad. Those poor folks who bought years ago for list price - they must be kicking themselves. If you are one of them, don't worry, there will be others in your shoes in the future!

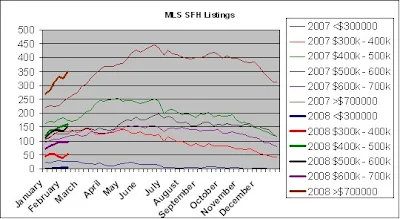

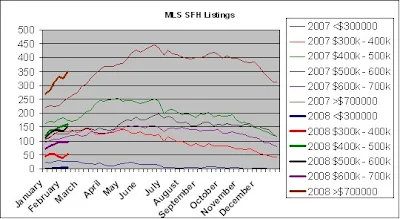

Housing inventory continues to climb. There are 122 more properties for sale since my last posting on January 27. That includes 56 more condos, 57 more SFH, 2 more townhomes. The last 7 must be lots, or trailers, or some other category. Looking at the SFH graph, it's easy to see that inventory is rising faster this year than last.

Housing inventory continues to climb. There are 122 more properties for sale since my last posting on January 27. That includes 56 more condos, 57 more SFH, 2 more townhomes. The last 7 must be lots, or trailers, or some other category. Looking at the SFH graph, it's easy to see that inventory is rising faster this year than last.

Sunday, January 27, 2008

January 26 Week Ending Stats

Sunday, January 20, 2008

January 19

Inventory of homes in Greater Victoria is increasing quite rapidly this year. In the past two weeks, there's been an increase of 119 SFH listed on MLS. Since January 7, there's been an increase of 423 active listings in the region. Homes are still selling, but new listings are certainly outpacing the sales (also see what's happening in Vancouver!)

A couple things of note:

- It's nice to see that Canada has their own version of Lawrence Yun and David Lehreah - Gregory Klump! Check this guy out and what he has to say!

- Our favourite condo development gone bad, Tuscany Village, had a couple of interesting sales last year. According to BC Assessments, unit 418 - 1620 McKenzie Ave is assessed at $476000 and sold for $339900 on October 5. Unit 419 - 1620 McKenzie is assessed at $461000 and sold for $346625 on October 9. How would you like to be the person who bought unit 411 - 1620 McKenzie Ave, assessed for $449000, but you paid $500000 (June 27)!!!

- Another Tuscany note, unit 413 - 1620 McKenzie had an asking price of $510195 in May. Today, it is $419900 (MLS#237359). I thought real estate always went up! If you're in the market for a condo, this is the place to make a low ball offer.

- Is the Radius condo / commercial development the next Tuscany Village??? This link from the TC used to work. No longer for me. Anyways, here was the beginning...

Costs stall Radius project

Carolyn Heiman, Times Colonist

Published: Saturday, January 12, 2008

Skyrocketing construction costs, which some experts say are rising 1.5 per cent a month, have temporarily stalled work on the $160-million Radius project, says the developer.

But John Schucht of Waywell Development said the project -- kitty-corner to the Save-on-Foods Memorial Centre -- will resume after a reassessment of construction costs in the region, which he described as "runaway."

Schucht said a construction hiatus was planned for the Christmas holiday but instead of resuming on Jan. 7, the break will be longer. He declined to say how much longer.

A couple things of note:

- It's nice to see that Canada has their own version of Lawrence Yun and David Lehreah - Gregory Klump! Check this guy out and what he has to say!

- Our favourite condo development gone bad, Tuscany Village, had a couple of interesting sales last year. According to BC Assessments, unit 418 - 1620 McKenzie Ave is assessed at $476000 and sold for $339900 on October 5. Unit 419 - 1620 McKenzie is assessed at $461000 and sold for $346625 on October 9. How would you like to be the person who bought unit 411 - 1620 McKenzie Ave, assessed for $449000, but you paid $500000 (June 27)!!!

- Another Tuscany note, unit 413 - 1620 McKenzie had an asking price of $510195 in May. Today, it is $419900 (MLS#237359). I thought real estate always went up! If you're in the market for a condo, this is the place to make a low ball offer.

- Is the Radius condo / commercial development the next Tuscany Village??? This link from the TC used to work. No longer for me. Anyways, here was the beginning...

Costs stall Radius project

Carolyn Heiman, Times Colonist

Published: Saturday, January 12, 2008

Skyrocketing construction costs, which some experts say are rising 1.5 per cent a month, have temporarily stalled work on the $160-million Radius project, says the developer.

But John Schucht of Waywell Development said the project -- kitty-corner to the Save-on-Foods Memorial Centre -- will resume after a reassessment of construction costs in the region, which he described as "runaway."

Schucht said a construction hiatus was planned for the Christmas holiday but instead of resuming on Jan. 7, the break will be longer. He declined to say how much longer.

Wednesday, January 9, 2008

2008 Poll Results

Very interesting results from this last week's polls. Of course, it wasn't very scientific. But, that's ok. Here they are...

53% (33 of 62) of you are pessimistic about 2008. I'm sorry to hear that. Pray tell...

73% (53 of 72) believe that Victoria's average SFH selling price will be lower in 2008 than 2007. Let's hope so.

52% (36 of 69) think that Canada's economy will go into recession in 2008. Are you the pessimistic ones?

95% (66 of 69) know that the U.S. economy will go into recession this year.

78% (54 of 69) think that the loonie will remain above par with the greenback. This may hasten our recession.

33% (22 of 65) think oil will hit $100 this year. So far, you're right.

23% (15 of 65) think $110.

29% (19 of 65) think $120. Hmm...

13% (9 of 65) are shooting for the stars - $150. Or maybe not. Did you all vote late in the polls?

62% (39 of 62) believe that we'll be going to the federal polls this year.

92% (61 of 66) think that the oval office will be headed by a democrat. Not very surprising.

Great! Thanks for taking part. Feel free to comment on the results.

53% (33 of 62) of you are pessimistic about 2008. I'm sorry to hear that. Pray tell...

73% (53 of 72) believe that Victoria's average SFH selling price will be lower in 2008 than 2007. Let's hope so.

52% (36 of 69) think that Canada's economy will go into recession in 2008. Are you the pessimistic ones?

95% (66 of 69) know that the U.S. economy will go into recession this year.

78% (54 of 69) think that the loonie will remain above par with the greenback. This may hasten our recession.

33% (22 of 65) think oil will hit $100 this year. So far, you're right.

23% (15 of 65) think $110.

29% (19 of 65) think $120. Hmm...

13% (9 of 65) are shooting for the stars - $150. Or maybe not. Did you all vote late in the polls?

62% (39 of 62) believe that we'll be going to the federal polls this year.

92% (61 of 66) think that the oval office will be headed by a democrat. Not very surprising.

Great! Thanks for taking part. Feel free to comment on the results.

Sunday, January 6, 2008

December Sales Numbers

I'm a little late on this one. I'm glad it's getting discussed in the previous posts' comments. Thus, I won't comment much here on the December numbers. However, I will throw out the graphs.

Single family home sales for the past three years. Look at the regional sales prices on the VREB website. Those million dollar SFH sales had to have only been in Oak Bay, Saanich East, and Victoria (maybe one in North Saanich). The other regions, they are either below or only marginally above the 6 month average.

Condo sales.

Townhome sales.

Finally, months of inventory for all properties. Where is it going to go from here?

The football game has finally ended. Thank goodness! The Bulls kicker made a field goal. A Bears player made a late hit on the kicker, and a side clearing brawl ensued. Those Bears are sore losers! I'm just kidding. I'm just a bitter renter. Final score, Bulls 32, Bears 19.

Single family home sales for the past three years. Look at the regional sales prices on the VREB website. Those million dollar SFH sales had to have only been in Oak Bay, Saanich East, and Victoria (maybe one in North Saanich). The other regions, they are either below or only marginally above the 6 month average.

Condo sales.

Townhome sales.

Finally, months of inventory for all properties. Where is it going to go from here?

The football game has finally ended. Thank goodness! The Bulls kicker made a field goal. A Bears player made a late hit on the kicker, and a side clearing brawl ensued. Those Bears are sore losers! I'm just kidding. I'm just a bitter renter. Final score, Bulls 32, Bears 19.

Tuesday, January 1, 2008

Happy New Year!

A new year has begun. For some, this means overcoming a hangover, others, time to reflect, speculate, or make goals for the next 366 days. I'm not a believer in resolutions. However, it is nice to start a new year in order to make statements like "I haven't had a smoke this year" or "The Canucks haven't lost this year". Those statements often don't last very long.

What will 2008 bring? I'm pretty excited - I think it will be a very interesting year. I feel that there is much at the tipping point. Governments, economies, real estate, beer prices. Regarding RE, I'd be along the lines of HHV's predictions. Victoria has peaked, but without the help of a major external influence, will not crash this year.

I thought it would be interesting to get all of your takes on what is in store for 2008. I've created a few polls on the side - please do place your votes. And as usual, comment away. I always enjoy reading them!

What will 2008 bring? I'm pretty excited - I think it will be a very interesting year. I feel that there is much at the tipping point. Governments, economies, real estate, beer prices. Regarding RE, I'd be along the lines of HHV's predictions. Victoria has peaked, but without the help of a major external influence, will not crash this year.

I thought it would be interesting to get all of your takes on what is in store for 2008. I've created a few polls on the side - please do place your votes. And as usual, comment away. I always enjoy reading them!

Subscribe to:

Comments (Atom)