The Victoria Real Estate Board released the

May sales statistics today. I definitely appreciate the promptness of VREB in releasing the monthly numbers. Thanks!

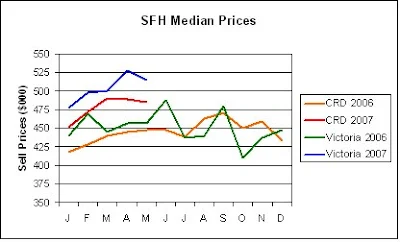

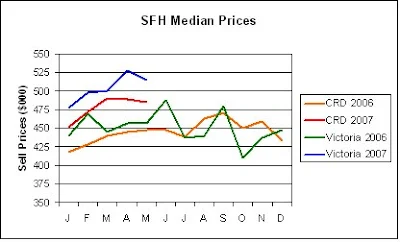

So, sales are up, listings are up, but prices are down slightly. If the average SFH selling price was about $200000 less, I'd say Victoria was in a pretty good real estate / housing market position. However, average and medians are still ridiculous.

I expected the monthly inventory to be higher than it was. Active listings for May was 3462. With the high number of sales, 963, we currently have 3.6 months of inventory. According to that, we are still in a seller's market. However, if you add to the inventory the thousands of condos and townhomes you could buy today but are not listed on MLS, the picture changes.

Saanich, Sooke, and Langford had busy SFH sales months. It's pretty amazing how the real estate face of Langford is changing. Can you believe that the average selling price of a home in Langford (let's say it with a

twang) is over 1/2 million dollars! Some of those homes on Bear Mountain must be selling. It surprises me because watching the listings for the region on MLS is like watching Fred Flintstone run past the same rock and window over and over again.

Victoria proper didn't have a huge number of SFH sales, and the median and average prices took a hit. Again, there was a significant number of waterfront homes sold, skewing the numbers.

The condo market is showing signs of softening. May 2007 had a drop of 11% in sales versus May 2006. Also, even with the increased sales number for this past month, 11 fewer condos sold in May than April. Average selling price was $6000 less than the 6 month average. I've heard others say that the first market segment to show signs of weakness in a declining housing market is the condo market. I'd say that we are seeing that now.

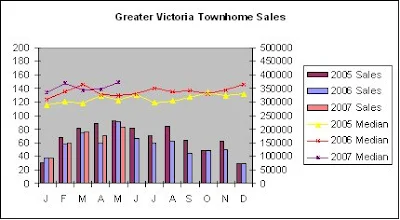

Townhome sales were strong in May - 83 sales with an increase in average selling price. There were 20 townhomes sold in Saanich East!

I'm happy to announce that I didn't go into a bout of depression after reading this months numbers. As "strong" as they were, this was a bearish month. Inventory is continuing to rise, affordability is going nowhere, and we know that interest rate hikes are coming. Prices dropped slightly, but it was nothing that I am going to write home about.

The Bears are on the scoreboard with a field goal. The score is Bulls 16, Bears 3, with 5 minutes left in the 1st half.