The great thing about this blog is that even when I'm not available to write a new post, it creates a life of it's own! Thanks for all the commentary and interesting discussions!

I'm still enjoying summer vacation. Spent a little time in Seattle, rode the Space Needle (might it prick their bubble?) The parents are out from the prairies for the next week. In showing them the sights, it'll be good to be a bit of a tourist in my new home town.

Here's a couple notes or points of discussion:

- A lot of listings are absolutely languishing on MLS.

- Yet, homes are selling. Co-worker sold his house in Broadmead for near asking price in 3 days!

- Alberta real estate inventory is climbing like crazy.

- CMHC newsletter points out that housing starts this year are still above last year. Most of the June starts were in Langford.

- Interest rates have risen and will continue to rise. How will this affect yourself and / or your family / friends?

Have a great week!

Update - BC Real Estate Association news release for sales numbers for year to date. (Hat tip to S2)

Tuesday, July 17, 2007

Saturday, July 7, 2007

July 7 Week Ending Stats

Sorry folks, no week ending stats today. The new MLS.ca website appears to be spitting out some unusual results. I'm still tracking the numbers, but I'm not sure if they are valid. If they are, this last week saw a decrease of 131 SFH listings! I'm gonna continue to track the numbers over the next couple weeks. If they continue as they are, then we have had a huge decrease in inventory. If the numbers jump back to the old trend, then we know that this week's results were not valid. I'll keep you posted.

Thanks.

Also, I'll be taking a couple weeks of vacation in July, so posting may be spotty. It's time to smell the roses.

Thanks.

Also, I'll be taking a couple weeks of vacation in July, so posting may be spotty. It's time to smell the roses.

Tuesday, July 3, 2007

June Sales Numbers

VREB has release the June sales numbers. A lot of sales, record average and median prices for Greater Victoria. And of course, the dribble from Bev McIvor about how "it’s important to note that nearly a third of single family homes last month sold for under $425,000". Why is that important? What validity is there to that statistic? Anyways...

It really was a strong real estate month for Victoria. No doubt about it. Yes, listings are up, but only "13%" higher than last year. Considering the demise of the American housing market, what explanation can be given for our strong RE market? Some possibilities:

- Victoria truly is different, RE is local, they aren't making any more land, everyone wants to live here, etc., etc., etc., yadda, yadda, yadda.

- Panic buying due to the coming interest rate increases.

- Sellers are still finding greater fools.

Regarding the 13% increase in inventory. This is a false number because there are hundreds of housing units (condos) available for sale which are not listed through MLS, thus do not show up in the VREB's monthly number. I'm not sure what the true number of properties available for sale is. I'd venture to guess it's around 1000 more than being reported. Now that number is more significant.

Following is the graph for comparison of median SFH sales prices of Greater Victoria and Victoria proper. It's interesting how the median for Victoria city took a nose-dive in June. Year-over-year, it's a negative increase.

A few other items of note:

- West Saanich had a higher average and median price than Victoria city.

- Victoria city had the greatest SFH average price decrease in comparison to the 6 month average.

- Saanich East and West had a combined 157 SFH sales. Since 2005, this is the third highest SFH monthly sales number.

- On June 23, CFAX1070 reported that Aquattro in Colwood sold 50 units that weekend. VREB is reporting that only 8 condos sold in Colwood in all of June.

- Only 1 condo reported sold in View Royal. The Aspen must have closed it's sales doors. Yet they are reporting 40% sold!?

- 96 townhome sales for Greater Victoria is the highest monthly total ever!?

Touchdown for the Bulls. The Bears don't have much to cheer about. The score: Bulls 23, Bears 3. End of the 2nd quarter.

It really was a strong real estate month for Victoria. No doubt about it. Yes, listings are up, but only "13%" higher than last year. Considering the demise of the American housing market, what explanation can be given for our strong RE market? Some possibilities:

- Victoria truly is different, RE is local, they aren't making any more land, everyone wants to live here, etc., etc., etc., yadda, yadda, yadda.

- Panic buying due to the coming interest rate increases.

- Sellers are still finding greater fools.

Regarding the 13% increase in inventory. This is a false number because there are hundreds of housing units (condos) available for sale which are not listed through MLS, thus do not show up in the VREB's monthly number. I'm not sure what the true number of properties available for sale is. I'd venture to guess it's around 1000 more than being reported. Now that number is more significant.

Following is the graph for comparison of median SFH sales prices of Greater Victoria and Victoria proper. It's interesting how the median for Victoria city took a nose-dive in June. Year-over-year, it's a negative increase.

A few other items of note:

- West Saanich had a higher average and median price than Victoria city.

- Victoria city had the greatest SFH average price decrease in comparison to the 6 month average.

- Saanich East and West had a combined 157 SFH sales. Since 2005, this is the third highest SFH monthly sales number.

- On June 23, CFAX1070 reported that Aquattro in Colwood sold 50 units that weekend. VREB is reporting that only 8 condos sold in Colwood in all of June.

- Only 1 condo reported sold in View Royal. The Aspen must have closed it's sales doors. Yet they are reporting 40% sold!?

- 96 townhome sales for Greater Victoria is the highest monthly total ever!?

Touchdown for the Bulls. The Bears don't have much to cheer about. The score: Bulls 23, Bears 3. End of the 2nd quarter.

Saturday, June 30, 2007

June 30 Week Ending Stats

This week had a decrease in the number of single family home listings on MLS.ca for Greater Victoria. The largest decrease in listings were SFH with an asking price higher than $700000. There was in increase in listings of SFH with prices between $300k and $400k and between $500k and $600k.

Condo listings on MLS.ca appear to have spiked, however, that may be due to the new search feature. It appears that townhomes are sometimes included in the results when searching for condos. Last week had 547 - 2 bedroom condo listings. This week - 612.

Tomorrow is July. VREB will likely release the June sales numbers on Tuesday, the 3rd. I have a gut feeling that the number of sales for June will be over 900. Driving around town, there appear to be a lot of "Sold" signs. A sales number of 900 would be nearly a 20% increase from last year. I think that inventory will also have increased, but not by much. Regarding prices, I don't have the faintest idea. This blogs commenter's say that property sales are selling for under list. This doesn't necessitate a decrease in average selling price though. I'm looking forward to the numbers in a couple days.

Have a great long weekend! Happy Canada Day!

Condo listings on MLS.ca appear to have spiked, however, that may be due to the new search feature. It appears that townhomes are sometimes included in the results when searching for condos. Last week had 547 - 2 bedroom condo listings. This week - 612.

Tomorrow is July. VREB will likely release the June sales numbers on Tuesday, the 3rd. I have a gut feeling that the number of sales for June will be over 900. Driving around town, there appear to be a lot of "Sold" signs. A sales number of 900 would be nearly a 20% increase from last year. I think that inventory will also have increased, but not by much. Regarding prices, I don't have the faintest idea. This blogs commenter's say that property sales are selling for under list. This doesn't necessitate a decrease in average selling price though. I'm looking forward to the numbers in a couple days.

Have a great long weekend! Happy Canada Day!

Thursday, June 28, 2007

CMHC "Housing Now" Report for May

CMHC released the May edition of "Housing Now" for Victoria, yesterday. You can find it here.

There wasn't much new news reported in the report. Victoria's condo construction remains at a 30 year high. Regarding all forms of housing, year to date starts are 11.7% higher than last year. The number of units under construction this May was 55% higher than May 2006. Yet, the number of units absorbed year to date are down 26.3% from last year. There is going to be a major glut of units come on stream in the next couple years. I honestly believe the developers are building too much, too fast, too soon.

Here's the graph of average SFH sale prices comparing the numbers from CMHC and the VREB. CMHC's average is lower because they remove waterfront, acreage, duplex, and manufactured home sales.

There wasn't much new news reported in the report. Victoria's condo construction remains at a 30 year high. Regarding all forms of housing, year to date starts are 11.7% higher than last year. The number of units under construction this May was 55% higher than May 2006. Yet, the number of units absorbed year to date are down 26.3% from last year. There is going to be a major glut of units come on stream in the next couple years. I honestly believe the developers are building too much, too fast, too soon.

Here's the graph of average SFH sale prices comparing the numbers from CMHC and the VREB. CMHC's average is lower because they remove waterfront, acreage, duplex, and manufactured home sales.

Monday, June 25, 2007

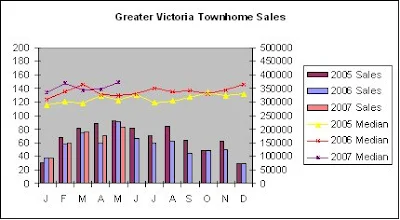

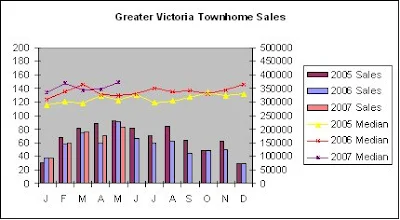

Focus on Townhome Sales

Some generalizations can be made regarding townhome sales in Greater Victoria over the past couple years - marginal median price increases, slightly declining sales numbers. However, the only consistent aspect of townhome sales in individual regions is their inconsistency. Some months have brought huge sales numbers, other months, very small sales numbers. Some months, huge year-over-year median price increases, others, large negative year-over-year prices.

The volume of townhome sales in Greater Victoria since 2005 has decreased ever so slightly. Median sales prices have risen marginally during that same period of time.

The City of Victoria had more townhome sales in 2005 than 2006 and thus far this year. The median price was all over the graph in 2005. 2006 and 2007 have not seen any real median sales prices increases.

In Langford, townhome sales numbers are showing monthly increases this year over previous years, with the exception of May of 2006. Median prices have been steadily rising.

Saanich has seen consistent townhomes sales over the past 2 1/2 years. The monthly median price flip-flopped back and forth in 2005 and 2006. 2007 has seen a monthly year-over-year price increase each month. December 2006 had a very distorted median price due to very low sales volume.

Finally, year-over-year percent increases of median sales prices. There is no obvious trend. I would attribute this to there having not been a huge run-up in sales prices of townhomes since 2005. Even with the continued building of luxury properties, the median price of townhomes have not risen as substantially as that of single family homes. Or have they?

Or have they?

The volume of townhome sales in Greater Victoria since 2005 has decreased ever so slightly. Median sales prices have risen marginally during that same period of time.

The City of Victoria had more townhome sales in 2005 than 2006 and thus far this year. The median price was all over the graph in 2005. 2006 and 2007 have not seen any real median sales prices increases.

In Langford, townhome sales numbers are showing monthly increases this year over previous years, with the exception of May of 2006. Median prices have been steadily rising.

Saanich has seen consistent townhomes sales over the past 2 1/2 years. The monthly median price flip-flopped back and forth in 2005 and 2006. 2007 has seen a monthly year-over-year price increase each month. December 2006 had a very distorted median price due to very low sales volume.

Finally, year-over-year percent increases of median sales prices. There is no obvious trend. I would attribute this to there having not been a huge run-up in sales prices of townhomes since 2005. Even with the continued building of luxury properties, the median price of townhomes have not risen as substantially as that of single family homes.

Or have they?

Or have they?

Saturday, June 23, 2007

June 23 Week Ending Stats

My apologies, my Saturday graphs must be getting very boring already. They appear the same every week. But believe me, every Saturday morning, I glean MLS.ca, put the numbers into my spreadsheet, and create a new graph. The trend is the same every week. Rising inventory of expensive homes, stable inventory of lower priced homes. Expensive homes continue to be a larger percentage of the homes for sale, while "entry level" homes' piece of the pie chart continues to decline.

This week, 23 more SFH listed on MLS. Notably, 9 of them in the $500k - $600k price range, 9 of them priced above $700k.

The percentage of homes for sale with an asking price of less than $500k continues to decrease. Only 32.7% of SFH listed have such an asking price.

There are 199 SFH listed today with an asking price of $1 million or higher. For comparison, Calgary, with nearly equal real estate prices and 3 times our population, there are 253 SFH listed for $1 million and above.

My rant today. We all know that the run-up in prices was due to low interest rates, the mass media, deceptive realtors and alternative mortgage options. I've probably missed pointing my finger at someone. Today, all of the sheeple have become complacent and accepted that today's prices are realistic and, simply put, that's the price of a home. I don't believe that out-of-towners and baby boomers are buying up our average single family homes with plans of retiring to them in the coming years. Why would they buy a house now, then have the house and yard sit empty for months on end (assuming they'd live here for only part of the year)? It makes much more sense for them to be buying condos and townhomes - low maintenance properties. Thus, Victoria's rise in SFH prices is the fault of people living in Victoria. Now, as inventory rises, and prices stay the same, again it's the fault of the locals. Luxury condos built for out-of-towners is an entirely different market. Why are young families murdering their futures by taking out $400000 mortgages? Because we've been deceived that it's a necessary evil to having your own home! Something has gotta give...

This week, 23 more SFH listed on MLS. Notably, 9 of them in the $500k - $600k price range, 9 of them priced above $700k.

The percentage of homes for sale with an asking price of less than $500k continues to decrease. Only 32.7% of SFH listed have such an asking price.

There are 199 SFH listed today with an asking price of $1 million or higher. For comparison, Calgary, with nearly equal real estate prices and 3 times our population, there are 253 SFH listed for $1 million and above.

My rant today. We all know that the run-up in prices was due to low interest rates, the mass media, deceptive realtors and alternative mortgage options. I've probably missed pointing my finger at someone. Today, all of the sheeple have become complacent and accepted that today's prices are realistic and, simply put, that's the price of a home. I don't believe that out-of-towners and baby boomers are buying up our average single family homes with plans of retiring to them in the coming years. Why would they buy a house now, then have the house and yard sit empty for months on end (assuming they'd live here for only part of the year)? It makes much more sense for them to be buying condos and townhomes - low maintenance properties. Thus, Victoria's rise in SFH prices is the fault of people living in Victoria. Now, as inventory rises, and prices stay the same, again it's the fault of the locals. Luxury condos built for out-of-towners is an entirely different market. Why are young families murdering their futures by taking out $400000 mortgages? Because we've been deceived that it's a necessary evil to having your own home! Something has gotta give...

Tuesday, June 19, 2007

Today's Cartoon

Hat tip to the Times Colonist for today's cartoon. Is this the TSN turning point?

Hat tip to the Times Colonist for today's cartoon. Is this the TSN turning point?On another note, phase 4 of the Railyards development has a price review underway. I'd say, 90% chance prices are going down, 10% chance prices are going up.

Which development is next?

Sunday, June 17, 2007

Deception!

I'm outraged! The latest ad for Reflections in Langford is absolute and total deception! The ad states that you can now buy a 2 bedroom condo valued at $334900 for zero money down, thus giving you a $995 monthly payment for the first twelve months (whatever that means!). First of all, zero money down is a poor financial decision (we are now NO different than what went on in the U.S.). Secondly, $995 a month, yeah right. Put into a mortgage calculator the $334900 purchase price, 40 year amortization, 5.99% interest rate, what do you get - $1823.23 a month! What the...!!! I wonder, is it Peter Gaby or the developers sensing a serious downturn that are willing to pay for half your mortgage for the first year!

I'm outraged! The latest ad for Reflections in Langford is absolute and total deception! The ad states that you can now buy a 2 bedroom condo valued at $334900 for zero money down, thus giving you a $995 monthly payment for the first twelve months (whatever that means!). First of all, zero money down is a poor financial decision (we are now NO different than what went on in the U.S.). Secondly, $995 a month, yeah right. Put into a mortgage calculator the $334900 purchase price, 40 year amortization, 5.99% interest rate, what do you get - $1823.23 a month! What the...!!! I wonder, is it Peter Gaby or the developers sensing a serious downturn that are willing to pay for half your mortgage for the first year!People, don't do it! It's all lies!

Sorry, I've gotta take some deep breaths here. If Gaby and/or the developer wanted to maintain a stitch of integrity, they'd simply lower the prices and present the real purchase numbers. However, they know that to present that same monthly mortgage payment, even with the 40 year amortization, the price of that particular condo would have to be $183000. Wow, that's almost reasonable!

Saturday, June 16, 2007

June 16 Week Ending Stats

Inventory of MLS.ca listings are up this week. There are 23 more SFH listings this Saturday than last Saturday. The largest increase in inventory is homes priced above $700000.

I've been tracking the number of listings of 3 bedroom SFH, 3 bedroom townhomes, and 2 bedroom condos for nearly 1 year. The number of listings of 3 bd SFH and 2 bd condos are nearly at the levels of last summer. Listings of 3 bd townhomes are more than double last year at this time.

With the rising interest rates this past month, will this affect your mortgage payments or spending habits? Do you know of family and friends that are concerned / not concerned about the rising rates?

CTV had an online poll on whether an interest rate hike was welcomed to slow inflation. 65% of respondents did not welcome the interest rate hike. I think this is indicative of the current household mortgage situation - people's lives will be affected by rising rates. As a non-mortgage holder, I certainly welcome the rising rates, as I believe that inflation is much higher than the Bank of Canada is depicting it as. Inflation affects everyone, not just homeowners.

I've been tracking the number of listings of 3 bedroom SFH, 3 bedroom townhomes, and 2 bedroom condos for nearly 1 year. The number of listings of 3 bd SFH and 2 bd condos are nearly at the levels of last summer. Listings of 3 bd townhomes are more than double last year at this time.

With the rising interest rates this past month, will this affect your mortgage payments or spending habits? Do you know of family and friends that are concerned / not concerned about the rising rates?

CTV had an online poll on whether an interest rate hike was welcomed to slow inflation. 65% of respondents did not welcome the interest rate hike. I think this is indicative of the current household mortgage situation - people's lives will be affected by rising rates. As a non-mortgage holder, I certainly welcome the rising rates, as I believe that inflation is much higher than the Bank of Canada is depicting it as. Inflation affects everyone, not just homeowners.

Subscribe to:

Comments (Atom)