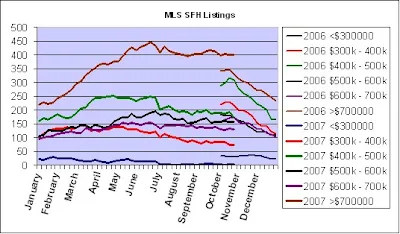

SFH listings on MLS are down slightly this week. Here's a new graph for perspective on how the SFH market has changed from one year ago. I'll probably continue to graph SFH listings numbers in this format from now on.

Condo listings continue to rise. 1243 condos listed on MLS this morning. There were 1214 last Saturday, 1181 two weeks ago, 1138 three weeks ago. This rise in condos listings will put the VREB month end active listings numbers above September 2007 and above October 2006. I think we may actually come close to our peak listings from June of this year. This would put the market at six months of inventory.

In the circle of people I know, a few of them have mentioned that they think the market is softening, and are debating on putting their homes up for sale. They don't need to sell, but if they can get such and such a price, they would sell. That's fine for them, but I don't think that approach is selling homes today. A home in Victoria needs to be very competitively priced to sell quickly. This appears to also apply to new condo and townhome developments.

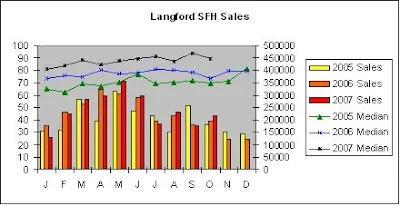

Take

Casa Bella townhomes in Langford in comparison to the townhomes of

Reflections,

The Pearl on Hillside, and

Richmond Gate. Casa Bella has sold like hotcakes, the others are not, to say the least. Casa Bella homes are the same size or larger, and priced less than the others. It doesn't surprise me that they have essentially sold out (21 - three bedroom units). Reflections has not sold one townhome, The Pearl has sold 2 of their 5, Richond Gate has sold 2 of their 6.

I know this sounds like a plug for Casa Bella. It's not intended to be. I think they represented value for your money compared to others. That's what it takes to sell in today's market.

I wonder how long the developers (or whoever put the initial investment forward) of Tuscany Village, Richmond Gate, The Breakwater, The Julia, and others, can hold out before we see some

real price decreases.

Comparing the number of SFH listings this year to last year, even with the decreasing numbers, they don't appear to be dropping as fast. In fact, in the $500k to $600k range, the number of SFH listings has been flat since early August. However, last year on this weekend, there were 1073 SFH listed. Today, 884 listed. The market for SFH under $500k is still very tight.

Comparing the number of SFH listings this year to last year, even with the decreasing numbers, they don't appear to be dropping as fast. In fact, in the $500k to $600k range, the number of SFH listings has been flat since early August. However, last year on this weekend, there were 1073 SFH listed. Today, 884 listed. The market for SFH under $500k is still very tight. Thank a veteran this weekend for the sacrifice they made for our freedoms today. Have a great Remembrance Day Weekend!

Thank a veteran this weekend for the sacrifice they made for our freedoms today. Have a great Remembrance Day Weekend!