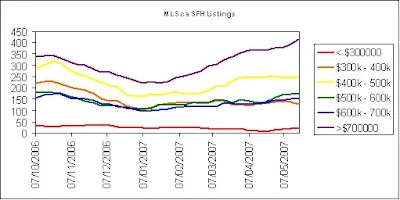

63.2% of all single family homes listed today for Greater Victoria on MLS.ca have an asking price of $500000 or higher. 14.4% of SFH are listed for $400000 or less.

The number of listings for SFH priced above $500k continues to rise faster than SFH listed under $500k.

I'm trying to wrap my head around some stats based on April's numbers and today's SFH "asking price" dollar range percentages. The median selling price for SFH in April was $489000. Therefore, more that 50% of SFH sold for less than $500k, less than 50% of SFH sold for more than $500k. Based on the number of listings on MLS today, 36.8% of SFH have an asking price of <= $500k, 63.2% of SFH have an asking price of >=$500k.

Some of the following numbers are estimates, but I think the general idea will come across. Based on my calculations, approximately 50% of the listings for Greater Victoria on MLS are SFH. According to VREB, there were 3305 active listings in April. Let's assume then that 50% of the active listings were SFH, 1653.

Using today's MLS percentage numbers, if there were 1653 SFH listed in April, 36.8% will have been listed for under $500k. This gives us 608 SFH under $500k. 63.2% will have been listed for over $500k. This gives us 1045.

467 SFH were sold in April. The median was $489000. More than 233.5 SFH sold for less than $500k, less than 233.5 SFH sold for more than $500k. For simplicity, I'll use those numbers. SFH under $500k, 233.5 sales, 608 listings, this equals 2.6 months of inventory. SFH over $500k, 233.5 sales, 1045 listings, this equals 4.5 months of inventory.

What does this all point to? Price compression? Sputtering upper-end? A seller's market? Perhaps a number of things. A quick search on the web regarding months-of-inventory and 6.0 came up as the MOI switching point between seller's and buyer's markets. This leads me to believe that based on April's numbers, Victoria's Real Estate market is still a seller's market, with homes priced under $500k very much favouring sellers. Homes prices over $500k are moving closer to a buyer's market, but not yet there.

Spring is a busy selling season. The MOI should move closer to a buyer's market over the summer. However, for a major shift, we will need significantly more listings and / or fewer sales.