This will be my final post.

We've bought a house. The deal is done, conditions are removed. We're about to become home-debtors, no longer renters. My father put it nicely, we'll be renting from the bank, not from a landlord. So true...

We're happy. We're excited to move into the new place. I'm already making a list of things I'd like to do around the house. I'm looking forward to cutting the grass, planting a garden (next year of course), painting, having our own bedroom, a garage to work on the car, a place to put down roots and really become a part of the larger community.

I think we got a half decent deal on the house, as far as deals go. Can you really call any deal these days a good deal? I've already noticed within myself my lack of interest in the real estate market. It's become boring to me. I now don't want to see prices crash, as we are now vested. My attitude has changed in that way. Before buying and becoming vested in the market, I wanted to see the market tank. I even wanted the economy as a whole to tank. I thought that we'd make it through the tough times and come out better on the other end. But today, I no longer wish these things. I don't really care if housing prices rise, because it won't affect us - we're in this for the long term, not to make a profit. I now find myself cheering the economy on, believing that this will stabilize the housing market, and that there will be lots of work for everyone!

Thanks to everyone for participating and reading this blog. I've enjoyed having it and providing a forum for discussion. I think I've learnt through it (although, some of you may disagree!), and had a place to vent my opinions. Unfortunately, my zealousness has severely decreased since my wife and I welcomed our little prairiegirl into the world. I love the quote that Just Jack gave after her birth "Astronomers are unable to find the centre of the Universe. You just found yours." Exactly! I hope that another forum for discussion can be found. I think it's great how HHV is broadening his blog to include financial topics.

I feel like today is a bit of an end of an era for me. This blog has been a part of my life for quite a while and become a small community in itself. However, it has now run it's course. It would be interesting to meet a lot of you, but I think that some feel like I've betrayed the readers of this blog, and I don't care to deal with that negativity. I don't believe I've betrayed anyone. My purpose of the blog was not to be a doomsayer or trash the real estate market, but rather to have a better understanding of it. We've bought because it was the right time for us, and that is the only reason.

Thanks again. Have a great summer, enjoy our beautiful city and country, and God bless!

Saturday, July 18, 2009

Wednesday, July 1, 2009

Early June Sales Numbers

Of course, June sales numbers won't be out until tomorrow at the earliest. So here are my SFH sales estimates. Average price should be close to $600000, probably between $590k and $600k. June 2009 average will be higher than June 2008. Median looks to be around $535000. Total SFH sold in June will be slightly lower than May. I'd estimate that total VREB sales for June will also be a little lower than May, but higher than June 2008. It's a wide range, but sales should be between 750 and 850 for June. Inventory has also dropped - last night I recorded 4126 properties for sale, as per this realtor's website. This morning they show 3911 properties for sale. Inventory is significantly lower this June than June 2008.

We've put an offer on a house. They countered, we countered, they countered, and we couldn't agree on a price. We were disappointed, but in hindsight, I firmly believe it was a blessing in disguise. The search continues....

We've put an offer on a house. They countered, we countered, they countered, and we couldn't agree on a price. We were disappointed, but in hindsight, I firmly believe it was a blessing in disguise. The search continues....

Sunday, June 14, 2009

Where we're at...

I'll try to jot down a couple thoughts before the little one wakes from her nap.

Thus far, we've gone through approximately a dozen open houses and seen 6 homes with our realtor. We haven't been wowed by anything yet, probably due to our expectations, which I feel are likely unrealistic for today's market. Yesterday at an open house, people were swarming like flies on poop, and the showing realtor said that the previous day, 7 offers had been submitted. Hearing that, our stay was not very long. It looks like with the current low mortgage rates, every FTB has come out of the woodwork. Frustrating, needless to say.

And the business is showing - so far this month, I'm estimating 15 SFH sales per day, with the average price hovering around $590000, the median at $540000.

We've also seen a mortgage broker. I was somewhat surprised at what we got pre-approved for. A little scary in fact. My wife and I aren't comfortable with the debt load we are allowed to carry, so I doubt we'll be pushing the envelope with our purchase - when it happens. I've been happy with our mortgage broker experience thus far. He didn't want to push us off a cliff, which was nice. Funny though how the approval went straight to a 35 year amortization - no talk even of anything less. It does appear that 35 years is the new norm. With it being that way, I don't see the price of entry level homes coming down much at all for many years - at least until mortgage rates rise significantly. There are simply more FTBs looking for 3 bedroom homes around $350k to $450k than there are homes available.

Thus far, we've gone through approximately a dozen open houses and seen 6 homes with our realtor. We haven't been wowed by anything yet, probably due to our expectations, which I feel are likely unrealistic for today's market. Yesterday at an open house, people were swarming like flies on poop, and the showing realtor said that the previous day, 7 offers had been submitted. Hearing that, our stay was not very long. It looks like with the current low mortgage rates, every FTB has come out of the woodwork. Frustrating, needless to say.

And the business is showing - so far this month, I'm estimating 15 SFH sales per day, with the average price hovering around $590000, the median at $540000.

We've also seen a mortgage broker. I was somewhat surprised at what we got pre-approved for. A little scary in fact. My wife and I aren't comfortable with the debt load we are allowed to carry, so I doubt we'll be pushing the envelope with our purchase - when it happens. I've been happy with our mortgage broker experience thus far. He didn't want to push us off a cliff, which was nice. Funny though how the approval went straight to a 35 year amortization - no talk even of anything less. It does appear that 35 years is the new norm. With it being that way, I don't see the price of entry level homes coming down much at all for many years - at least until mortgage rates rise significantly. There are simply more FTBs looking for 3 bedroom homes around $350k to $450k than there are homes available.

Sunday, May 24, 2009

The Debate Continues...

I appreciate all the comments following my announcement in my last post. Thanks to those wishing us luck, we'll need it, and to the others that think it's a stupid decision, that's ok too. I lost some sleep last night thinking about it all.

I do continue to debate within myself whether this is the right decision for my family. At this point, I do believe it is. My frustration comes from fellow renters who brag about how cheaply they have been renting a house for the past 5, or 7, or 10 years! Yes, rent was much cheaper then, and your landlord can only increase your rent to a max of 4% annually. Try finding the same place today - I don't think you can. A quick scan of homes for rent on Craigslist, UsedVic, and the TC, shows that you only get shiite for $1600 / month. So, you can rent from the bank or you can rent from a landlord. You know, I am tired of this debate. Both are not great options. I've owned a house in my past - I am not naive to all that is involved. I know that when we find the right place for the right price, the happiness level for our family will be higher than if we move into another rental. That is worth something - for everything else there is Mastercard! hahaha...

Looking at sales throughout Greater Victoria thus far this month, we are on pace to have around 430 SFH sales. The average sale price thus far is around $585000, the median is around $535000. Low interest rates are definitely affecting home sales.

We're off to some open houses... stay tuned.

I do continue to debate within myself whether this is the right decision for my family. At this point, I do believe it is. My frustration comes from fellow renters who brag about how cheaply they have been renting a house for the past 5, or 7, or 10 years! Yes, rent was much cheaper then, and your landlord can only increase your rent to a max of 4% annually. Try finding the same place today - I don't think you can. A quick scan of homes for rent on Craigslist, UsedVic, and the TC, shows that you only get shiite for $1600 / month. So, you can rent from the bank or you can rent from a landlord. You know, I am tired of this debate. Both are not great options. I've owned a house in my past - I am not naive to all that is involved. I know that when we find the right place for the right price, the happiness level for our family will be higher than if we move into another rental. That is worth something - for everything else there is Mastercard! hahaha...

Looking at sales throughout Greater Victoria thus far this month, we are on pace to have around 430 SFH sales. The average sale price thus far is around $585000, the median is around $535000. Low interest rates are definitely affecting home sales.

We're off to some open houses... stay tuned.

Monday, May 18, 2009

Phase Shift

Like the new title? At the request of you guys, we'll try it out. I can't say I'm a gold bug, so you'll have to further spur on the conversation.

I am slightly shifting the focus of my blog from this point on. Reason being, I've recently completed some career enhancing studies, and it's time for the next phase in the life of my family. This is the year that we will be purchasing a home of some sort in Greater Victoria. I can already hear the boos and hisses, but that's ok. Little Prairiegirl is getting bigger every day, and we are out-growing our little apartment suite. Sure, we could find a house to rent, but quite frankly, I am tired of moving around and what to put roots down. If it were possible to time the market, and if we could wait longer, we would. But you can't time the market, and we have to move this year, so we're going to jump in, with eyes wide open.

Our search criteria is quite wide at this point - we will be examining a number of options including building new (which would include putting in some sweat equity), buying a fixer upper, buying with a suite, however, preferably without a suite. Our goal is to find a place that we can realistically afford, to be in a good family neighbourhood, and to plan to stay in our place for 10 years. Sounds easy, right? We'll see.

I am slightly shifting the focus of my blog from this point on. Reason being, I've recently completed some career enhancing studies, and it's time for the next phase in the life of my family. This is the year that we will be purchasing a home of some sort in Greater Victoria. I can already hear the boos and hisses, but that's ok. Little Prairiegirl is getting bigger every day, and we are out-growing our little apartment suite. Sure, we could find a house to rent, but quite frankly, I am tired of moving around and what to put roots down. If it were possible to time the market, and if we could wait longer, we would. But you can't time the market, and we have to move this year, so we're going to jump in, with eyes wide open.

Our search criteria is quite wide at this point - we will be examining a number of options including building new (which would include putting in some sweat equity), buying a fixer upper, buying with a suite, however, preferably without a suite. Our goal is to find a place that we can realistically afford, to be in a good family neighbourhood, and to plan to stay in our place for 10 years. Sounds easy, right? We'll see.

Tuesday, April 21, 2009

What's up with this market?

I don't know what to make of Victoria's real estate market. The lower interest rates do appear to be having an effect on the bottom end of the single family home market. Prices are not receding as I thought they would. And inventory is certainly not rising as I thought it would.

Today, there are 4257 properties for sale in Greater Victoria, according to this realtor's website. On March 22, I recorded 4311 properties for sale from the same website.

At the pace of sales so far this month, there should be approximately 330 - 340 SFH sold in April. Yes, this is less than last year, but not by much. Average sale price is hovering around $565000, the median around $525000.

The market peak for the year is usually in April and May. Perhaps what we are seeing is exactly to be expected. Any observations from the condo market?

Today, there are 4257 properties for sale in Greater Victoria, according to this realtor's website. On March 22, I recorded 4311 properties for sale from the same website.

At the pace of sales so far this month, there should be approximately 330 - 340 SFH sold in April. Yes, this is less than last year, but not by much. Average sale price is hovering around $565000, the median around $525000.

The market peak for the year is usually in April and May. Perhaps what we are seeing is exactly to be expected. Any observations from the condo market?

Wednesday, April 1, 2009

March Sales Numbers

The VREB has released the March real estate sales numbers for Victoria. I got dizzy reading their report because of all of the spin!

Sunday, March 29, 2009

March Madness

March is going to be touted by the VREB as another month of a stable and balanced real estate market in Greater Victoria. They will likely continue to compare stats month-to-month, as that spins them in their favour.

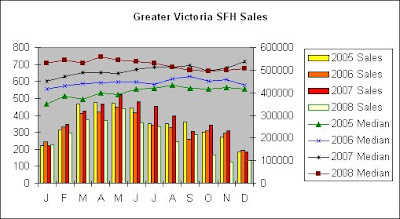

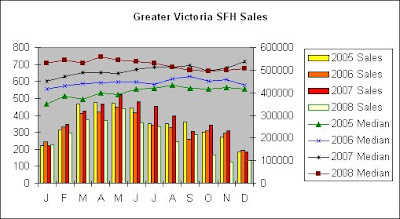

Of the stats I'm keeping, it looks like March will have approximately 290 SFH sales, with an average between $535k and $540k. The median will be around $515k. Month-over-month this looks impressive. What about year-over-year? Last March, there were 374 sales, with an average of $597k and a median of around $530k. Now this March doesn't look so impressive.

Sorry, I don't have any info regarding townhomes and condos.

Of the stats I'm keeping, it looks like March will have approximately 290 SFH sales, with an average between $535k and $540k. The median will be around $515k. Month-over-month this looks impressive. What about year-over-year? Last March, there were 374 sales, with an average of $597k and a median of around $530k. Now this March doesn't look so impressive.

Sorry, I don't have any info regarding townhomes and condos.

Tuesday, March 17, 2009

Deal... or No Deal?

Due to the underwhelming success of the auction at Reflections in Langford, they have again lowered prices. This time, they are following the cues of Finlayson Reach and St. Andrew's Walk by chopping their prices by up to 40%. Good discount, but are they now good prices? What is the fair market value?

Some feel that fair market value is equal rent to ownership costs. I'll go with that. What would a 1 bedroom and den unit at Reflections rent for? Maybe $1100 / month? Strata fees and taxes for that unit would be maybe $250 / month. Subtract those from the rent = $850 / month mortgage payment. Today, you can get a 5 year fixed for 4.09%. With a 35 year amortization, you'd have a $180000 mortgage. Of course, you'd still need to cover a down payment and other associated fees (CMHC, property transfer tax, etc). The cheapest unit advertised is still $199000. That price is close, but still too high.

Some feel that fair market value is equal rent to ownership costs. I'll go with that. What would a 1 bedroom and den unit at Reflections rent for? Maybe $1100 / month? Strata fees and taxes for that unit would be maybe $250 / month. Subtract those from the rent = $850 / month mortgage payment. Today, you can get a 5 year fixed for 4.09%. With a 35 year amortization, you'd have a $180000 mortgage. Of course, you'd still need to cover a down payment and other associated fees (CMHC, property transfer tax, etc). The cheapest unit advertised is still $199000. That price is close, but still too high.

Sunday, March 15, 2009

Bear Market at Bear Mountain

Bear Mountain is calling it a bear market and slashing prices at Finlayson Reach and St. Andrews Walk. This was mentioned over at Vibrant Victoria a couple days ago, just haven't had the time to post it yet. H/T to anonymous for mentioning it in the comments of the last post.

Also, H/T to anonymous regarding the auction at Reflections - Chek6 reported that 15 of the 40 units sold. So, 25 condos left. When's the no reserve auction?

Apparently, a local realtor sent out the following email recently. I thought it was good for a laugh.

"You may already know, but I wanted to ensure that you were aware of two significant developments that occurred last week in the Victoria Real Estate Market.

Firstly, Bank of Canada interest rates dropped by another half point followed by most Chartered Banks. Prime Rate now stands at 2.5% which is unprecedented in a generation.

Secondly, the Victoria Real Estate Board announced that the number of sales in the Greater Victoria Region had risen substantially during the month of January over the previous two months.

The reaction in the marketplace to these two events was immediate and dramatic. Buyers sensed that the market was turning and that prices would now begin to stabilize after months of decline and uncertainty. This combined with record low mortgage rates resulted in an amazing number of accepted offers over the weekend on listings that in many cases enjoyed multiple offers. It has been a while since this kind of market activity has been evident in the Greater Victoria Region.

It is a great time to buy and more and more people are recognizing the opportunities that are available."

P.S. Just saw the money printing video, thanks HHV for the link. These are scary times. Thanks Obama.

Also, H/T to anonymous regarding the auction at Reflections - Chek6 reported that 15 of the 40 units sold. So, 25 condos left. When's the no reserve auction?

Apparently, a local realtor sent out the following email recently. I thought it was good for a laugh.

"You may already know, but I wanted to ensure that you were aware of two significant developments that occurred last week in the Victoria Real Estate Market.

Firstly, Bank of Canada interest rates dropped by another half point followed by most Chartered Banks. Prime Rate now stands at 2.5% which is unprecedented in a generation.

Secondly, the Victoria Real Estate Board announced that the number of sales in the Greater Victoria Region had risen substantially during the month of January over the previous two months.

The reaction in the marketplace to these two events was immediate and dramatic. Buyers sensed that the market was turning and that prices would now begin to stabilize after months of decline and uncertainty. This combined with record low mortgage rates resulted in an amazing number of accepted offers over the weekend on listings that in many cases enjoyed multiple offers. It has been a while since this kind of market activity has been evident in the Greater Victoria Region.

It is a great time to buy and more and more people are recognizing the opportunities that are available."

P.S. Just saw the money printing video, thanks HHV for the link. These are scary times. Thanks Obama.

Thursday, February 26, 2009

Monday, February 23, 2009

New Post, YEAH!

Ok, here's a new post.

Picked up today's Macleans. Front cover was the housing bust. Read it online, it's ok.

I've been enjoying Garth Turner's posts these days. Seems that since he lost his political seat, he has much more time for his blog. Maybe he found his calling.

Oh yeah, real estate in Victoria. At this point, it looks like February average SFH sales price should come in around $520k, median at $485k. Total SFH sales should be around 200 for the month, big improvement over January, a far cry from previous Februaries.

Picked up today's Macleans. Front cover was the housing bust. Read it online, it's ok.

I've been enjoying Garth Turner's posts these days. Seems that since he lost his political seat, he has much more time for his blog. Maybe he found his calling.

Oh yeah, real estate in Victoria. At this point, it looks like February average SFH sales price should come in around $520k, median at $485k. Total SFH sales should be around 200 for the month, big improvement over January, a far cry from previous Februaries.

Saturday, January 31, 2009

2008 Poll Review

The little one is finally asleep for a Saturday morning nap. I thought I'd take a look at the old blog. Holy Crap! 215 comments, better write a new post.

First, from my SFH sales monitoring, it looks like January will have an average selling price of around $525000, with the median coming in around $475000. I'd estimate around 130 SFH sales for the month.

I've been meaning for the past month to review the poll I put out there at the beginning of 2008. Of course, it hasn't happened, till now. The results were posted in my January 9, 2008 blog.

At the beginning of 2008, 53% of you were pessimistic about 2008. It all depends on how you look at it. For me, it was a good year. How about for you?

73% thought that Victoria's average SFH selling price would be lower in 2008 than 2007. It wasn't. The average for 2007 was $565904. The average for 2008 was $585701.

52% thought that Canada would enter a recession in 2008. I believe that remains to be seen, as Stats Canada has not released numbers for December yet.

95% knew that the U.S. would enter a recession in 2008.

78% thought that the loonie would remain above par with the greenback. Nope.

13% of us were close to predicting how high oil would rise - $150. The final peak for the year was just over $147 (correct me if I'm wrong).

62% thought we'd go to the polls in 2008. We almost went twice!

92% believed the next U.S. president would be a democrat. How right they were.

January sales numbers come out in a couple days. They should be interesting. Have a great weekend.

First, from my SFH sales monitoring, it looks like January will have an average selling price of around $525000, with the median coming in around $475000. I'd estimate around 130 SFH sales for the month.

I've been meaning for the past month to review the poll I put out there at the beginning of 2008. Of course, it hasn't happened, till now. The results were posted in my January 9, 2008 blog.

At the beginning of 2008, 53% of you were pessimistic about 2008. It all depends on how you look at it. For me, it was a good year. How about for you?

73% thought that Victoria's average SFH selling price would be lower in 2008 than 2007. It wasn't. The average for 2007 was $565904. The average for 2008 was $585701.

52% thought that Canada would enter a recession in 2008. I believe that remains to be seen, as Stats Canada has not released numbers for December yet.

95% knew that the U.S. would enter a recession in 2008.

78% thought that the loonie would remain above par with the greenback. Nope.

13% of us were close to predicting how high oil would rise - $150. The final peak for the year was just over $147 (correct me if I'm wrong).

62% thought we'd go to the polls in 2008. We almost went twice!

92% believed the next U.S. president would be a democrat. How right they were.

January sales numbers come out in a couple days. They should be interesting. Have a great weekend.

Saturday, January 10, 2009

Holding their breath

I have a quick question (or two).

These days, how long can a developer hold on to the hope of selling their condo units for nearly the full price after a project has been completed?

How long is it, after a building is completed, yet not sold out, until a developer has a fire sale?

Here's a partial list of developments in Victoria that are completed, or near, and still have units for sale - Bayview, Chelsea, Dockside Green, Aria, Juliet, Redstone, Breakwater, Palladian, Pearl, Vicino, Gateway, Aspen, Tuscany, Centennial Walk, Richmond Gate, Julia, Madrona Creek, Carriage Pointe, Finlayson Reach, Reflections, Stonehaven, Goldstream Station, Strathmore, Tara, La Vie, and I've probably missed some.

These days, how long can a developer hold on to the hope of selling their condo units for nearly the full price after a project has been completed?

How long is it, after a building is completed, yet not sold out, until a developer has a fire sale?

Here's a partial list of developments in Victoria that are completed, or near, and still have units for sale - Bayview, Chelsea, Dockside Green, Aria, Juliet, Redstone, Breakwater, Palladian, Pearl, Vicino, Gateway, Aspen, Tuscany, Centennial Walk, Richmond Gate, Julia, Madrona Creek, Carriage Pointe, Finlayson Reach, Reflections, Stonehaven, Goldstream Station, Strathmore, Tara, La Vie, and I've probably missed some.

Saturday, January 3, 2009

Happy New Year! 3 days late...

Happy New Year everyone. God bless, and we'll see what 2009 brings, right? I love roller coasters.

VREB has released the numbers for December. Slow sales, ever so small price increase in SFH and condos. The new VREB prez, Chris Markham, put the usual spin on the numbers. It may be just me, be he doesn't appear to be the eternal optimist that Tony Joe was.

VREB has released the numbers for December. Slow sales, ever so small price increase in SFH and condos. The new VREB prez, Chris Markham, put the usual spin on the numbers. It may be just me, be he doesn't appear to be the eternal optimist that Tony Joe was.

Subscribe to:

Posts (Atom)