The November edition of CMHC's "Housing Now" report for Victoria is now available.

Highlights include (the usual):

- robust construction activity.

- low unemployment.

- a slowing in new home starts.

CMHC's construction volume graph changed this month. Last month, construction volume was displayed as a total for Greater Victoria. This month, it's a bar graph for the different regions (figure 1). Perhaps the change is due to the fact that the old graph was downright scary, as under construction numbers are at record highs, and continue increasing.

If Victoria's construction volume dropped from today's number of 3296 units under construction, to historical norms, around 1000 units under construction, I wonder what the city's unemployment level would be. What if construction dropped to 1990's levels?

But of course, that will never happen. Everyone wants to live here and housing will never go down.

Thursday, December 27, 2007

Saturday, December 22, 2007

Merry Christmas!

Merry Christmas to you all, God bless, and please take time to reflect and enjoy family and friends over the next couple days!

I'll try to get one more post in before the new year, hoping to spark conversation on what 2008 will bring. I've had to take a small hiatus from the blog to study for a career-related challenge exam this past week. Thanks for keeping up the commentary. I do enjoy taking time to read what is on everyones' mind.

On a RE note, we can all sleep well this Christmas knowing that Victoria's and VI's real estate market will never go down, because our economy will never slow down, at least according to the article in today's TC! Is it arrogance, naivety, or pure deceit to say and think that with all that is going on in Canada, North America, and the World, that we truly are an island and that nothing affects us? I wonder how such opinions would change if Victoria wasn't on an island, but rather the mainland. I'm sure some other bogus argument would be found.

The number of listings on MLS.ca has rapidly decreased for SFH the past couple weeks. For condos and townhomes, it's a different story. The number of condo listings continues to be very high. This will be due to the developments around town.

Finally, I just thought I'd post a couple of funny pictures I found while browsing Google for a Christmas picture. I hope they don't offend anyone. Merry Christmas!

I'll try to get one more post in before the new year, hoping to spark conversation on what 2008 will bring. I've had to take a small hiatus from the blog to study for a career-related challenge exam this past week. Thanks for keeping up the commentary. I do enjoy taking time to read what is on everyones' mind.

On a RE note, we can all sleep well this Christmas knowing that Victoria's and VI's real estate market will never go down, because our economy will never slow down, at least according to the article in today's TC! Is it arrogance, naivety, or pure deceit to say and think that with all that is going on in Canada, North America, and the World, that we truly are an island and that nothing affects us? I wonder how such opinions would change if Victoria wasn't on an island, but rather the mainland. I'm sure some other bogus argument would be found.

The number of listings on MLS.ca has rapidly decreased for SFH the past couple weeks. For condos and townhomes, it's a different story. The number of condo listings continues to be very high. This will be due to the developments around town.

Finally, I just thought I'd post a couple of funny pictures I found while browsing Google for a Christmas picture. I hope they don't offend anyone. Merry Christmas!

Saturday, December 8, 2007

December 8 Week Ending Stats

The quantity of SFH listings on the MLS continues to trend downward as we approach Christmas. There are 63 fewer SFH listed this Saturday than last.

Condo listings are trending down also, but not as quickly. There are 27 fewer condos listed today. Townhomes listings are bucking the trend. There is 1 more listing today than last Saturday.

Condo listings are trending down also, but not as quickly. There are 27 fewer condos listed today. Townhomes listings are bucking the trend. There is 1 more listing today than last Saturday.

Thursday, December 6, 2007

You Know the Local RE Market is HOT when...

Kinetic Construction Ltd. is suing Tuscany Village Holding Ltd. for $2,245,982. (Business Examiner Vancouver Island Edition, Dec.3 - Dec16, Who's Suing Whom)

Want a cheap condo? It might be a good time to go and low-ball Tuscany Village!

Want a cheap condo? It might be a good time to go and low-ball Tuscany Village!

Monday, December 3, 2007

November Sales Numbers

VREB has posted November's sales numbers. I was close on my estimates! Except for the average townhome price, the numbers don't surprise me. Bev McIvor's two bits have changed from "it’s important to note that nearly a third of single family homes last month sold for under $425,000" this last summer to "The high demand and robust prices show continued strong consumer confidence in the market" this fall. Also, I got a flyer in the mail today from "Condo Conroy" stating "There are FAR fewer units on the market right now than there was last year..." I call bullsh**.

It appears that stuff is still selling. The number that speaks the most to me is 623 sales. That is 9% more than last November, and more than November 2005. The market does still have legs. I'm beginning to think it will take something big to knock those legs out from under it.

It was a bullish month. The Bulls scored a field goal. Score is Bulls 29, Bears 19.

It appears that stuff is still selling. The number that speaks the most to me is 623 sales. That is 9% more than last November, and more than November 2005. The market does still have legs. I'm beginning to think it will take something big to knock those legs out from under it.

It was a bullish month. The Bulls scored a field goal. Score is Bulls 29, Bears 19.

Saturday, December 1, 2007

December 1 Week Ending Stats

The number of listings of homes of all types continues to decline. This can be attributed to the fact that it's only 24 days till Christmas!

From two weeks, there are

- 12 fewer condos listed on MLS.ca

- 9 fewer townhomes

- 53 fewer SFH

The decline in listings of SFH this year does not appear to be as steep as last year.

For November's VREB stats, I'm guessing active listings to have decreased to around 3200. This would be very near to last year's active listings for November. As for November's sales and prices, really, I have no idea. For fun, let's say 600 sales, SFH average price up from October, condo and townhome average down.

From two weeks, there are

- 12 fewer condos listed on MLS.ca

- 9 fewer townhomes

- 53 fewer SFH

The decline in listings of SFH this year does not appear to be as steep as last year.

For November's VREB stats, I'm guessing active listings to have decreased to around 3200. This would be very near to last year's active listings for November. As for November's sales and prices, really, I have no idea. For fun, let's say 600 sales, SFH average price up from October, condo and townhome average down.

CMHC "Housing Now" Report for October

CMHC has released their October "Housing Now" report for Victoria.

Sunday, November 25, 2007

There's always next year...

It's tough watching your team lose the big game. But hey, they were big-time underdogs, and did better than I expected. Thanks Bombers, for the run this year, and better luck next year!

Back to real estate. Tell me, if the market is so hot, as according to the VREB, are there ads in the TC like the following for developments that are complete or nearly complete. Shouldn't they be sold out?!?

Back to real estate. Tell me, if the market is so hot, as according to the VREB, are there ads in the TC like the following for developments that are complete or nearly complete. Shouldn't they be sold out?!?

Monday, November 19, 2007

Regional SFH Numbers

First of all, what a great couple of football games yesterday! Being from the prairies, I couldn't be happier! Winnipeg vs. Regina in the Grey Cup! Perhaps the CFL's greatest rivalry. Sunday's game should be a real barn-burner!

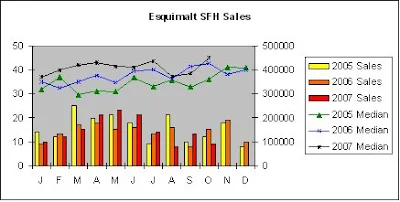

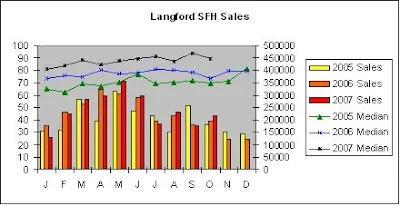

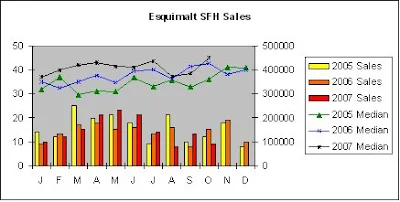

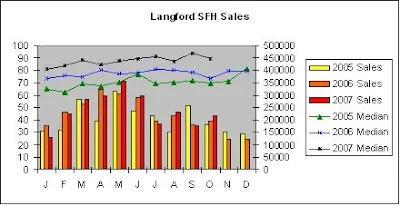

Back to real estate, following are graphs of sales numbers and median selling prices for Victoria, Saanich, Oak Bay, Esquimalt, and Langford. A picture is worth a thousand words, so that's all from me.

Victoria

Saanich

Oak Bay

Esquimalt

Langford

Back to real estate, following are graphs of sales numbers and median selling prices for Victoria, Saanich, Oak Bay, Esquimalt, and Langford. A picture is worth a thousand words, so that's all from me.

Victoria

Saanich

Oak Bay

Esquimalt

Langford

Saturday, November 17, 2007

November 17 Week Ending Stats

It's been a couple weeks since I posted week ending stats (to be exact, October 27 was the last). Based on MLS.ca, here is what I've seen since then.

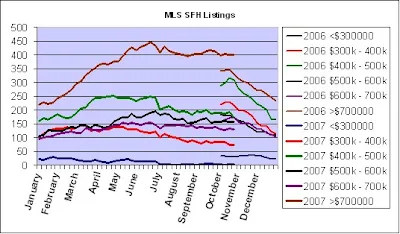

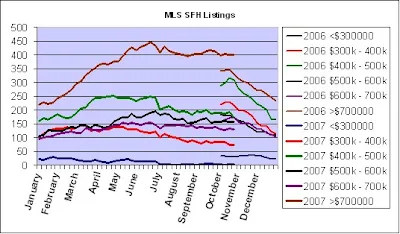

- There are 56 fewer SFH listed. The largest drop in listings is in the $400k to $500k price range (a drop of 22 listings - from 176 to 154)

- There are 20 more condos listed.

- There are 14 more townhomes listed.

Comparing the number of SFH listings this year to last year, even with the decreasing numbers, they don't appear to be dropping as fast. In fact, in the $500k to $600k range, the number of SFH listings has been flat since early August. However, last year on this weekend, there were 1073 SFH listed. Today, 884 listed. The market for SFH under $500k is still very tight.

Comparing the number of SFH listings this year to last year, even with the decreasing numbers, they don't appear to be dropping as fast. In fact, in the $500k to $600k range, the number of SFH listings has been flat since early August. However, last year on this weekend, there were 1073 SFH listed. Today, 884 listed. The market for SFH under $500k is still very tight.

On a side note, WOW!, unanimous decision on the CMHC. Mohican has started a new blog discussing dissolving the CMHC. Check it out.

- There are 56 fewer SFH listed. The largest drop in listings is in the $400k to $500k price range (a drop of 22 listings - from 176 to 154)

- There are 20 more condos listed.

- There are 14 more townhomes listed.

Comparing the number of SFH listings this year to last year, even with the decreasing numbers, they don't appear to be dropping as fast. In fact, in the $500k to $600k range, the number of SFH listings has been flat since early August. However, last year on this weekend, there were 1073 SFH listed. Today, 884 listed. The market for SFH under $500k is still very tight.

Comparing the number of SFH listings this year to last year, even with the decreasing numbers, they don't appear to be dropping as fast. In fact, in the $500k to $600k range, the number of SFH listings has been flat since early August. However, last year on this weekend, there were 1073 SFH listed. Today, 884 listed. The market for SFH under $500k is still very tight.On a side note, WOW!, unanimous decision on the CMHC. Mohican has started a new blog discussing dissolving the CMHC. Check it out.

Friday, November 9, 2007

Lest We Forget...

Thank a veteran this weekend for the sacrifice they made for our freedoms today. Have a great Remembrance Day Weekend!

Thank a veteran this weekend for the sacrifice they made for our freedoms today. Have a great Remembrance Day Weekend!Some superficial topics to consider

- Stats Canada New Housing Price Index

- CMHC housing starts for October

- City of Victoria's new downtown plans

Monday, November 5, 2007

CMHC Q4 Housing Market Outlook

I'm sorry to interrupt the ongoing commentary. I just wanted to point out that CMHC has released their 4th quarter housing market outlook for Victoria. You can read it here.

Highlights according to CMHC are:

- Victoria's housing industry robust, growth spurred by strong economy.

- Resale market sales to edge down, prices to rise slowly.

- New homebuilding will level off in 2008.

- New home prices to rise.

- Rental vacancies will remain low.

I think I've heard that all before.

Highlights according to CMHC are:

- Victoria's housing industry robust, growth spurred by strong economy.

- Resale market sales to edge down, prices to rise slowly.

- New homebuilding will level off in 2008.

- New home prices to rise.

- Rental vacancies will remain low.

I think I've heard that all before.

Thursday, November 1, 2007

October Sales Numbers

VREB has released the October sales numbers. H/T to Roger for beating me to the punch for commentary and review. You can read it over at HHV.

Single family home sales and median prices over the past 3 years in Greater Victoria.

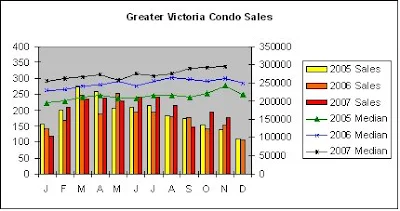

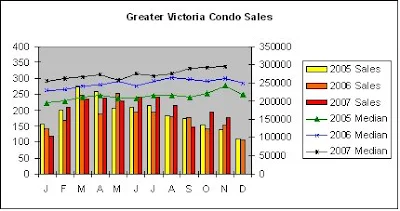

Condo sales and median sales prices.

Townhome sales and median sales prices.

Draw your own conclusions. I think it's started. Looks like a bearish month. I'm awarding a touchdown to the Bears. And wait! What's that? HHV's attempting a two point convert! The pass is up, ball's in the air... and... knocked down by the defender! Sorry HHV. I just couldn't do it. The score is now Bulls 26, Bears 19.

Single family home sales and median prices over the past 3 years in Greater Victoria.

Condo sales and median sales prices.

Townhome sales and median sales prices.

Draw your own conclusions. I think it's started. Looks like a bearish month. I'm awarding a touchdown to the Bears. And wait! What's that? HHV's attempting a two point convert! The pass is up, ball's in the air... and... knocked down by the defender! Sorry HHV. I just couldn't do it. The score is now Bulls 26, Bears 19.

Wednesday, October 31, 2007

CMHC "Housing Now" Report for September

CMHC has released their September 2007 edition of "Housing Now" for Victoria. It can be viewed here.

Highlights include:

- 17.8% fewer starts in September 2007 versus September 2006.

- 21.9% more units under construction this September versus last.

There was a significant average price increase between August and September.

The poll on the sidebar has produced interesting, yet not surprising, results. Most readers of this blog are bearish on real estate, but there are some bulls out there. I think that 2008 will be a critical year for real estate prices. If there are no price declines next year, I will probably start to believe that this time it is different.

Highlights include:

- 17.8% fewer starts in September 2007 versus September 2006.

- 21.9% more units under construction this September versus last.

There was a significant average price increase between August and September.

The poll on the sidebar has produced interesting, yet not surprising, results. Most readers of this blog are bearish on real estate, but there are some bulls out there. I think that 2008 will be a critical year for real estate prices. If there are no price declines next year, I will probably start to believe that this time it is different.

Saturday, October 27, 2007

October 27 Week Ending Stats

The number of listings on MLS.ca is down this Saturday in comparison to last Saturday. There are 22 fewer SFH, 11 fewer townhomes, and 17 fewer condos.

I'm gonna go out on a limb this week. I'm calling Victoria's average SFH sale price in September ($584193) as the peak average price for Victoria for the next couple years. With winter coming, what's going on in the U.S. and Alberta, and rising mortgage rates, I think we've hit the top. April 2008 will be the first time since March 2007 that Victoria has a year over year decrease in average SFH price. Average monthly prices for the summer of 2008 will be lower than the summer of 2007.

Of course, I am 100% amateur, and have nothing riding on this prediction (aside from house prices moving further from my affordability level if I'm wrong). Put only as much stock into this as you want.

As I write, I have friends bidding on a house in Victoria. As strongly as I feel, I try not to influence their decision. If I am wrong, and they hold back because of me, thus falling further behind the rising prices, I'm partially responsible. I don't want to be. Everyone needs to be responsible for their own decisions. If you are comfortable with the numbers, go ahead and seal the deal. I think that good things will come to those who wait.

Update: My friends bidding on the house did not get it. Reason being - after offers were supposed to be in, the selling realtor continued to show the house, and tell new interested parties what the current high offer was. It's pretty easy to place the highest offer when you know what second place will be. The ethics of some in the realtor profession continue to disappoint me.

I'm gonna go out on a limb this week. I'm calling Victoria's average SFH sale price in September ($584193) as the peak average price for Victoria for the next couple years. With winter coming, what's going on in the U.S. and Alberta, and rising mortgage rates, I think we've hit the top. April 2008 will be the first time since March 2007 that Victoria has a year over year decrease in average SFH price. Average monthly prices for the summer of 2008 will be lower than the summer of 2007.

Of course, I am 100% amateur, and have nothing riding on this prediction (aside from house prices moving further from my affordability level if I'm wrong). Put only as much stock into this as you want.

As I write, I have friends bidding on a house in Victoria. As strongly as I feel, I try not to influence their decision. If I am wrong, and they hold back because of me, thus falling further behind the rising prices, I'm partially responsible. I don't want to be. Everyone needs to be responsible for their own decisions. If you are comfortable with the numbers, go ahead and seal the deal. I think that good things will come to those who wait.

Update: My friends bidding on the house did not get it. Reason being - after offers were supposed to be in, the selling realtor continued to show the house, and tell new interested parties what the current high offer was. It's pretty easy to place the highest offer when you know what second place will be. The ethics of some in the realtor profession continue to disappoint me.

Saturday, October 20, 2007

October 20 Week Ending Stats

SFH listings on MLS are down slightly this week. Here's a new graph for perspective on how the SFH market has changed from one year ago. I'll probably continue to graph SFH listings numbers in this format from now on.

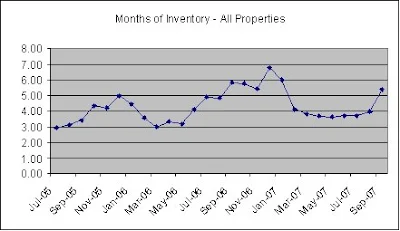

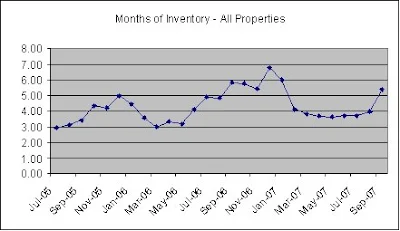

Condo listings continue to rise. 1243 condos listed on MLS this morning. There were 1214 last Saturday, 1181 two weeks ago, 1138 three weeks ago. This rise in condos listings will put the VREB month end active listings numbers above September 2007 and above October 2006. I think we may actually come close to our peak listings from June of this year. This would put the market at six months of inventory.

In the circle of people I know, a few of them have mentioned that they think the market is softening, and are debating on putting their homes up for sale. They don't need to sell, but if they can get such and such a price, they would sell. That's fine for them, but I don't think that approach is selling homes today. A home in Victoria needs to be very competitively priced to sell quickly. This appears to also apply to new condo and townhome developments.

Take Casa Bella townhomes in Langford in comparison to the townhomes of Reflections, The Pearl on Hillside, and Richmond Gate. Casa Bella has sold like hotcakes, the others are not, to say the least. Casa Bella homes are the same size or larger, and priced less than the others. It doesn't surprise me that they have essentially sold out (21 - three bedroom units). Reflections has not sold one townhome, The Pearl has sold 2 of their 5, Richond Gate has sold 2 of their 6.

I know this sounds like a plug for Casa Bella. It's not intended to be. I think they represented value for your money compared to others. That's what it takes to sell in today's market.

I wonder how long the developers (or whoever put the initial investment forward) of Tuscany Village, Richmond Gate, The Breakwater, The Julia, and others, can hold out before we see some real price decreases.

Condo listings continue to rise. 1243 condos listed on MLS this morning. There were 1214 last Saturday, 1181 two weeks ago, 1138 three weeks ago. This rise in condos listings will put the VREB month end active listings numbers above September 2007 and above October 2006. I think we may actually come close to our peak listings from June of this year. This would put the market at six months of inventory.

In the circle of people I know, a few of them have mentioned that they think the market is softening, and are debating on putting their homes up for sale. They don't need to sell, but if they can get such and such a price, they would sell. That's fine for them, but I don't think that approach is selling homes today. A home in Victoria needs to be very competitively priced to sell quickly. This appears to also apply to new condo and townhome developments.

Take Casa Bella townhomes in Langford in comparison to the townhomes of Reflections, The Pearl on Hillside, and Richmond Gate. Casa Bella has sold like hotcakes, the others are not, to say the least. Casa Bella homes are the same size or larger, and priced less than the others. It doesn't surprise me that they have essentially sold out (21 - three bedroom units). Reflections has not sold one townhome, The Pearl has sold 2 of their 5, Richond Gate has sold 2 of their 6.

I know this sounds like a plug for Casa Bella. It's not intended to be. I think they represented value for your money compared to others. That's what it takes to sell in today's market.

I wonder how long the developers (or whoever put the initial investment forward) of Tuscany Village, Richmond Gate, The Breakwater, The Julia, and others, can hold out before we see some real price decreases.

Thursday, October 18, 2007

What a relief!

Phew! What a relief! Boy, I'll be able to sleep good tonight!

Why, you ask? Well, it's because Re/Max has released their 2008 housing market forecast. I'm now ready to jump on board and buy the biggest house I possibly can. This is because it's going to rise in value by 5% next year. That's more than my savings account is getting! Besides, 5% of $500000 is a gain of $25000. Yippee, our real estate market has legs! And this is despite everything that is happening around us!

Seriously, why is any stock given to reports like this. The TC of course eats it up. Even if by fluke they are right, it's a totally biased report. It's totally useless. If even CMHC's numbers are suspect, how can a real estate firms' report be given any validation?

Sorry about the lack of blogging these days. I think I've hit the October doldrums. No, I've had those for a while. Real estate is getting a little boring. I want to see some action. Lets' see some price drops, crashes, and other signs of desperation. I don't want to see people get hurt, but my patience is growing thin.

Why, you ask? Well, it's because Re/Max has released their 2008 housing market forecast. I'm now ready to jump on board and buy the biggest house I possibly can. This is because it's going to rise in value by 5% next year. That's more than my savings account is getting! Besides, 5% of $500000 is a gain of $25000. Yippee, our real estate market has legs! And this is despite everything that is happening around us!

Seriously, why is any stock given to reports like this. The TC of course eats it up. Even if by fluke they are right, it's a totally biased report. It's totally useless. If even CMHC's numbers are suspect, how can a real estate firms' report be given any validation?

Sorry about the lack of blogging these days. I think I've hit the October doldrums. No, I've had those for a while. Real estate is getting a little boring. I want to see some action. Lets' see some price drops, crashes, and other signs of desperation. I don't want to see people get hurt, but my patience is growing thin.

Saturday, October 13, 2007

October 13 Week Ending Stats

The number of condo listings on MLS.ca for Greater Victoria was significantly up again this week. From reading the daily hotsheets, the increase appears to have been partially caused by the additional listings from the new Radius residential project. The number of two bedroom condos available on MLS has increased by 57 in two weeks.

SFH listed on MLS is up by 7 this week, but the total number is still down from previous weeks. Today, there are two SFH listed for under $300k. One year ago, on October 14, there were 33. Today, there are 83 SFH listed for between $300k and $400k. One year ago, 227.

SFH listed on MLS is up by 7 this week, but the total number is still down from previous weeks. Today, there are two SFH listed for under $300k. One year ago, on October 14, there were 33. Today, there are 83 SFH listed for between $300k and $400k. One year ago, 227.

Thursday, October 11, 2007

August New Housing Price Index

Stats Canada has release the New Housing Price Index for August.

The price of a new home in Victoria rose 0.4% between August 2006 and August 2007. Of the cities surveyed, this was the third smallest increase. Windsor (-2.8%) and Charlottetown (0.2%) lead the way. Canada as a whole had an increase of 6.5%.

The price of a new home in Victoria rose 0.4% between August 2006 and August 2007. Of the cities surveyed, this was the third smallest increase. Windsor (-2.8%) and Charlottetown (0.2%) lead the way. Canada as a whole had an increase of 6.5%.

Tuesday, October 9, 2007

September Housing Starts

CMHC has released the housing starts numbers for September. For Victoria, more starts than in August, less than September 2006, fewer year to date in 2007 than 2006. Canada-wide, it was big news.

A sizzling condominium market propelled Canadian housing starts in September to their highest level since 1978, a 19.6 percent monthly jump, which well exceeded analysts' expectations.

Perhaps I'm naive, but I don't quite get it. The housing market in the U.S. is officially in the tank. 50/50 chance of recession there. Good chance we follow. Our population growth isn't exactly setting land speed records. Is it just plain cool to have two or three properties under your belt? Are Canadians still speculating? Who's buying or going to buy all these properties???

A sizzling condominium market propelled Canadian housing starts in September to their highest level since 1978, a 19.6 percent monthly jump, which well exceeded analysts' expectations.

Perhaps I'm naive, but I don't quite get it. The housing market in the U.S. is officially in the tank. 50/50 chance of recession there. Good chance we follow. Our population growth isn't exactly setting land speed records. Is it just plain cool to have two or three properties under your belt? Are Canadians still speculating? Who's buying or going to buy all these properties???

Saturday, October 6, 2007

October 6 Week Ending Stats

MLS listings were up and down this week. There are 43 more condo listings today than there were last Saturday. I believe this is largely due to the release of units at the new Radius development. Kudos to them for listing on MLS. This will increase the month end inventory numbers, and thus give a truer picture of the number of homes that are for sale, unlike those condo developments that have hundreds of units for sale, but their inventory numbers are not taken into account by the VREB because they are not listed on MLS. Shame on them.

Single family home listings are down by 27 this week. Victoria is definitely not having the run-up in SFH inventory like cities in Alberta are. This leads me to think that SFH in Victoria are built for home-dwellers, not speculators. Otherwise, we should be seeing more of a rush to the exit, as evidenced in Alberta. Barring external forces, the SFH market should remain steady for a while to come. I wouldn't say the same for the condo market.

I meant to post this earlier in the week. There was an interesting article in Macleans regarding a possible coming recession, titled "Can you say recession?" Hat tip to whoever pointed it out to me - I wish I could remember. If you have the time, give it a read.

Single family home listings are down by 27 this week. Victoria is definitely not having the run-up in SFH inventory like cities in Alberta are. This leads me to think that SFH in Victoria are built for home-dwellers, not speculators. Otherwise, we should be seeing more of a rush to the exit, as evidenced in Alberta. Barring external forces, the SFH market should remain steady for a while to come. I wouldn't say the same for the condo market.

I meant to post this earlier in the week. There was an interesting article in Macleans regarding a possible coming recession, titled "Can you say recession?" Hat tip to whoever pointed it out to me - I wish I could remember. If you have the time, give it a read.

Monday, October 1, 2007

September Sales Numbers

I've now officially been forever priced out of the market!

Just kidding - that happened a long time ago!

Well, September numbers are out. My guesses were close. Total sales = 632. Total inventory = 3381 listings. Average prices up month over month in every category. Average prices up year over year everywhere. It's very reassuring that "There were 17 single family home sales of over $1 million and this had a significant impact on the overall average. Nearly a quarter of all single family homes sold for less than $425,000." Thank goodness for that!

Due to a shortness of time this evening, I'm gonna let the graphs do the talking.

Condo sales graph.

Townhome sales graph.

Single Family home sales graph.

Months of inventory graph.

Oh yeah, 3 points for the Bears. It's the end of the 3rd quarter. Bulls 26 Bears 13.

Just kidding - that happened a long time ago!

Well, September numbers are out. My guesses were close. Total sales = 632. Total inventory = 3381 listings. Average prices up month over month in every category. Average prices up year over year everywhere. It's very reassuring that "There were 17 single family home sales of over $1 million and this had a significant impact on the overall average. Nearly a quarter of all single family homes sold for less than $425,000." Thank goodness for that!

Due to a shortness of time this evening, I'm gonna let the graphs do the talking.

Condo sales graph.

Townhome sales graph.

Single Family home sales graph.

Months of inventory graph.

Oh yeah, 3 points for the Bears. It's the end of the 3rd quarter. Bulls 26 Bears 13.

Saturday, September 29, 2007

September 29 Week Ending Stats

There are 3 more single family homes, 13 more condos, and 7 more townhomes listed on MLS.ca this Saturday over last.

Interestingly, for SFH, the only price ranges that have a decrease in listings today are those priced under $300k and over $700k.

Let's dissect the graph of the number of SFH listings in a price range as a percentage of the whole. Over the past year, the percentage of listings between $500k and $700k has been quite flat. The percentage of listings of homes priced over $700k is nearly a mirror image of the percentage of home priced between $300k - $400k and $400k - $500k. The gradual down slope of homes priced between $300k and $500k has levelled off this past month, which leads me to wonder whether external factors (credit crunch, American MSM, affordability) are having an effect on the lower priced homes. Sales plus delists are not exceeding new listings. Perhaps this is the start of things.

Let's dissect the graph of the number of SFH listings in a price range as a percentage of the whole. Over the past year, the percentage of listings between $500k and $700k has been quite flat. The percentage of listings of homes priced over $700k is nearly a mirror image of the percentage of home priced between $300k - $400k and $400k - $500k. The gradual down slope of homes priced between $300k and $500k has levelled off this past month, which leads me to wonder whether external factors (credit crunch, American MSM, affordability) are having an effect on the lower priced homes. Sales plus delists are not exceeding new listings. Perhaps this is the start of things.

Case and point - a friend was pondering whether to get into the market. About three weeks ago, her realtor pointed out MLS#235514. The house was priced at $399000. In today's hot market, the house was going to sell that weekend. It's three weeks later, the house has not sold, and has had two price reductions, with it now sitting at $379000. How hot is this market? It's definitely cooling.

The Victoria Real Estate Board's September numbers should come out early next week. They should be interesting, but I'm not losing sleep over them. I'm guessing a decrease in SFH average price, an increase in condo and townhome average price. Listings will be up slightly to just over 3400, sales will be between 750 and 800, well above last year. What's your guess?

Interestingly, for SFH, the only price ranges that have a decrease in listings today are those priced under $300k and over $700k.

Let's dissect the graph of the number of SFH listings in a price range as a percentage of the whole. Over the past year, the percentage of listings between $500k and $700k has been quite flat. The percentage of listings of homes priced over $700k is nearly a mirror image of the percentage of home priced between $300k - $400k and $400k - $500k. The gradual down slope of homes priced between $300k and $500k has levelled off this past month, which leads me to wonder whether external factors (credit crunch, American MSM, affordability) are having an effect on the lower priced homes. Sales plus delists are not exceeding new listings. Perhaps this is the start of things.

Let's dissect the graph of the number of SFH listings in a price range as a percentage of the whole. Over the past year, the percentage of listings between $500k and $700k has been quite flat. The percentage of listings of homes priced over $700k is nearly a mirror image of the percentage of home priced between $300k - $400k and $400k - $500k. The gradual down slope of homes priced between $300k and $500k has levelled off this past month, which leads me to wonder whether external factors (credit crunch, American MSM, affordability) are having an effect on the lower priced homes. Sales plus delists are not exceeding new listings. Perhaps this is the start of things.Case and point - a friend was pondering whether to get into the market. About three weeks ago, her realtor pointed out MLS#235514. The house was priced at $399000. In today's hot market, the house was going to sell that weekend. It's three weeks later, the house has not sold, and has had two price reductions, with it now sitting at $379000. How hot is this market? It's definitely cooling.

The Victoria Real Estate Board's September numbers should come out early next week. They should be interesting, but I'm not losing sleep over them. I'm guessing a decrease in SFH average price, an increase in condo and townhome average price. Listings will be up slightly to just over 3400, sales will be between 750 and 800, well above last year. What's your guess?

Thursday, September 27, 2007

CMHC "Housing Now" Report for August

CMHC has released their "Housing Now" report for August for Victoria.

Highlights include

- 70.6% decrease in starts between August 2006 and August 2007.

- 2% decrease in starts year to date from 2006.

- 31.6% increase in units under construction between August 2006 and August 2007.

- Langford (pop. 22500) has 799 units under construction.

- Saanich (pop. 108000) has 536 units under construction.

- Oak Bay has 15 units under construction.

Those last three points aren't really highlights, I just found them to be interesting.

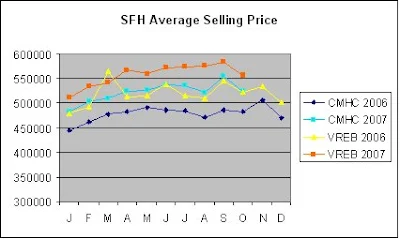

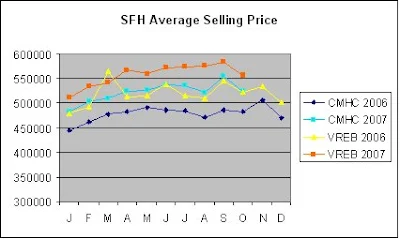

CMHC's average selling price for SFH dropped for the second straight month. The difference between CMHC's average price, which doesn't include waterfront, acreage, duplex, and manufactured home sales, and VREB's average price is very evident for August. The sale of a $5million home certainly skews the average. That's why I believe that median sales price is a better indicator.

Highlights include

- 70.6% decrease in starts between August 2006 and August 2007.

- 2% decrease in starts year to date from 2006.

- 31.6% increase in units under construction between August 2006 and August 2007.

- Langford (pop. 22500) has 799 units under construction.

- Saanich (pop. 108000) has 536 units under construction.

- Oak Bay has 15 units under construction.

Those last three points aren't really highlights, I just found them to be interesting.

CMHC's average selling price for SFH dropped for the second straight month. The difference between CMHC's average price, which doesn't include waterfront, acreage, duplex, and manufactured home sales, and VREB's average price is very evident for August. The sale of a $5million home certainly skews the average. That's why I believe that median sales price is a better indicator.

Sunday, September 23, 2007

September 22 Week Ending Stats

Tuesday, September 18, 2007

Big Rate Cut

As everyone has heard, the U.S. Federal Reserve cut the overnight lending rate by 50 basis points, or 0.5%. The experts were somewhat surprised. I am surprised that they were surprised. Yet, their response was exactly what I had heard it would be, if there was a cut of that size. The experts are afraid of what lies ahead.

What does lie ahead? What does it bring for me and my family, the city and province I live in, and for Canada?

A person could theorize and hypothesize until the cows come home. Even with that, they could still not get it right. If any one person could predict what was going to happen, well, they'd be very rich. Perhaps that is why statements from Warren Buffet and the likes are well heeded.

I have no idea. That's why I started this blog. But here's what I could possibly see. Rate cut in the U.S. - U.S. dollar drops - CAN$ rises - CAN exports continue to fall (except oil) - things slow even further in export reliant regions of CAN - CAN economy slows - rate cuts in CAN - housing market????

I'm no expert. What do you think? Where will B.C.'s and Canada's economies be in 1 year from now? 5 years from now?

What does lie ahead? What does it bring for me and my family, the city and province I live in, and for Canada?

A person could theorize and hypothesize until the cows come home. Even with that, they could still not get it right. If any one person could predict what was going to happen, well, they'd be very rich. Perhaps that is why statements from Warren Buffet and the likes are well heeded.

I have no idea. That's why I started this blog. But here's what I could possibly see. Rate cut in the U.S. - U.S. dollar drops - CAN$ rises - CAN exports continue to fall (except oil) - things slow even further in export reliant regions of CAN - CAN economy slows - rate cuts in CAN - housing market????

I'm no expert. What do you think? Where will B.C.'s and Canada's economies be in 1 year from now? 5 years from now?

Sunday, September 16, 2007

September 15 Week Ending Stats

The number of listings available on MLS.ca for Greater Victoria increased this past week. This includes

- 39 more condos.

- 3 more townhomes.

- 32 more SFH.

The largest increase in listings of SFH by price breakdown was in the $300k to $400k range. There are 10 more houses on MLS.ca in this price range this week.

Even with the increase in SFH listings, the pie chart breakdown is still very top heavy.

I think the increase in listings this past week is the beginning of the traditional run-up of inventory in the fall months. With the associated decrease in sales during fall, the months supply of inventory will increase. The September sales numbers will be very interesting.

- 39 more condos.

- 3 more townhomes.

- 32 more SFH.

The largest increase in listings of SFH by price breakdown was in the $300k to $400k range. There are 10 more houses on MLS.ca in this price range this week.

Even with the increase in SFH listings, the pie chart breakdown is still very top heavy.

I think the increase in listings this past week is the beginning of the traditional run-up of inventory in the fall months. With the associated decrease in sales during fall, the months supply of inventory will increase. The September sales numbers will be very interesting.

Friday, September 14, 2007

Slow Growth, Cool Market

Front page of today's TC had articles regarding Victoria's economic growth and real estate market. HouseHuntVictoria has insight on the related article in The Globe and Mail.

Victoria's economic growth to slow - rather significantly as well. 2006 had growth pegged at 3.7%. 2007 is forecasted at 2.8%.

Real estate market expected to cool over the long term - Victoria's current market is 10% above trend, according to Scotia Economics' Adrienne Warren. Quote from Cameron Muir "... it is reasonable to expect that when this current cycle is over that home prices will moderate for a while in order to give household incomes a chance to catch up with the pricing regime."

Does this mean that I may not be priced out forever?! Is today maybe not the best time to buy? Perhaps the future is better than the present for getting into the market. I'm surprised by Mr. Muir's statement. He may be starting to see the light.

Victoria's economic growth to slow - rather significantly as well. 2006 had growth pegged at 3.7%. 2007 is forecasted at 2.8%.

Real estate market expected to cool over the long term - Victoria's current market is 10% above trend, according to Scotia Economics' Adrienne Warren. Quote from Cameron Muir "... it is reasonable to expect that when this current cycle is over that home prices will moderate for a while in order to give household incomes a chance to catch up with the pricing regime."

Does this mean that I may not be priced out forever?! Is today maybe not the best time to buy? Perhaps the future is better than the present for getting into the market. I'm surprised by Mr. Muir's statement. He may be starting to see the light.

Tuesday, September 11, 2007

July New Housing Price Index

Statistics Canada has released the New Housing Price Index for July.

Once again, Victoria is showing some of the slowest month over month and year over year new house price gains. For the period of July 2006 to July 2007, Victoria had a 1.1% change in the new house price index. Tops was Saskatoon at 51.4%.

"For Canada, the pace of growth in new housing prices slowed for the 11th consecutive month in July. It went from 7.8% in June to 7.7% in July.

Saskatoon set a record high year-over-year increase for the fifth consecutive month. Prices in Winnipeg were 15.7% higher than in July 2006 in the wake of land shortages and development costs. New housing prices in Edmonton continued to increase at a fast pace with a year-over-year increase of 38.4%, due to hikes in land values from developers."

Go figure.

Once again, Victoria is showing some of the slowest month over month and year over year new house price gains. For the period of July 2006 to July 2007, Victoria had a 1.1% change in the new house price index. Tops was Saskatoon at 51.4%.

"For Canada, the pace of growth in new housing prices slowed for the 11th consecutive month in July. It went from 7.8% in June to 7.7% in July.

Saskatoon set a record high year-over-year increase for the fifth consecutive month. Prices in Winnipeg were 15.7% higher than in July 2006 in the wake of land shortages and development costs. New housing prices in Edmonton continued to increase at a fast pace with a year-over-year increase of 38.4%, due to hikes in land values from developers."

Go figure.

August Housing Starts

CMHC's housing starts report showed significant decreases in month over month and year over year housing starts for Greater Victoria. August 2007 had 110 housings starts. In comparison, July 2007 had 236 and August 2006 had 374. The number of housing starts for the year to date has 2007 only slightly behind 2006.

Does this signal anything? Is construction slowing down? I don't believe that one slow month represents a trend. With any new project coming online, next month's starts could be equally impressively high.

Does this signal anything? Is construction slowing down? I don't believe that one slow month represents a trend. With any new project coming online, next month's starts could be equally impressively high.

Saturday, September 8, 2007

September 8 Week Ending Stats

It's September. Fall is coming, the kids are back in school, and housing inventory should start to increase as the number of sales continues decreasing.

There was a slight SFH inventory increase this past week. The biggest changes are 5 fewer homes priced between $300k and $400k and 7 more homes priced between $500k and $600k. As of today, 72% of all single family homes listed on MLS.ca have an asking price of $500000 or higher.

I know this isn't a Calgary or Alberta housing market blog, but I love watching the average sale price posted on CREB's website drop. Calgary's average sale price has gone from $491k on August 23 (the peak was around $507k) to $477.5k today. That's nearly $14k in 16 days! I wonder how many Albertans will be scurrying to purchase our properties as their bubble bursts!

There was a slight SFH inventory increase this past week. The biggest changes are 5 fewer homes priced between $300k and $400k and 7 more homes priced between $500k and $600k. As of today, 72% of all single family homes listed on MLS.ca have an asking price of $500000 or higher.

I know this isn't a Calgary or Alberta housing market blog, but I love watching the average sale price posted on CREB's website drop. Calgary's average sale price has gone from $491k on August 23 (the peak was around $507k) to $477.5k today. That's nearly $14k in 16 days! I wonder how many Albertans will be scurrying to purchase our properties as their bubble bursts!

Tuesday, September 4, 2007

August Sales Numbers

HHV and Roger beat me to the punch for commentary on the VREB's release of the August sales numbers. Check out their blogs for some great insight.

All that's left is for me to bore you with some graphs, and an update to the football score.

Median single family home prices. Ouch, how the median in Victoria is dropping. The rest of the Capital Region District is really having to take up the slack.

Looking at sales of SFH in the past two years, the number of sales is higher this year. Median price appreciation continues at double digit or high single digit gains.

Condo sales numbers continue to be strong. However, the median price appreciation has been marginal the past couple of months.

This summer has been hot for sales of townhomes in Greater Victoria. The median sales price has been flat the past four months.

And finally, the Bears have scored a touchdown this month. The average sales price for condos and townhomes were lower than the six month rolling average. Without the sale of the $5million+ home in Oak Bay, average price of SFH would also have been lower than the six month average. Score: Bulls 26 Bears 10.

All that's left is for me to bore you with some graphs, and an update to the football score.

Median single family home prices. Ouch, how the median in Victoria is dropping. The rest of the Capital Region District is really having to take up the slack.

Looking at sales of SFH in the past two years, the number of sales is higher this year. Median price appreciation continues at double digit or high single digit gains.

Condo sales numbers continue to be strong. However, the median price appreciation has been marginal the past couple of months.

This summer has been hot for sales of townhomes in Greater Victoria. The median sales price has been flat the past four months.

And finally, the Bears have scored a touchdown this month. The average sales price for condos and townhomes were lower than the six month rolling average. Without the sale of the $5million+ home in Oak Bay, average price of SFH would also have been lower than the six month average. Score: Bulls 26 Bears 10.

Saturday, September 1, 2007

September 1 Week Ending Stats

Short entry today. SFH inventory on MLS.ca up slightly this past week. Townhome and condo inventory down slightly.

Tuesday should bring us August sales numbers. I'm guessing active listings will decrease to between 3300 and 3200 for the month. MLS sales to be above last year - between 750 and 800. Generally, I think sales prices will be down a little, not much. Any other guesses or predictions?

Tuesday should bring us August sales numbers. I'm guessing active listings will decrease to between 3300 and 3200 for the month. MLS sales to be above last year - between 750 and 800. Generally, I think sales prices will be down a little, not much. Any other guesses or predictions?

Thursday, August 30, 2007

CMHC "Housing Now" Report for July

First things first, for VG, here's the front page of the Edmonton Sun from earlier this week.

CMHC has released their "Housing Now" report for July. Housing starts for July 2007 were up 116.5% from July 2006. Year to date, starts are 18.9% higher in 2007.

Housing units under construction has the wow factor. There are 3278 housing units currently under construction in Greater Victoria. This is 52% higher than last July. Of that number, 2252 of those units are condos!

CMHC's average SFH selling price dropped slightly from June to July. Looking at their sales-to-active listings ratio, it appears to still be a sellers market. The townhome and condos markets are not quite as hot as the SFH market. Average selling price showed a month-over-month drop for both townhomes and condos.

Tuesday, August 28, 2007

Alberta's Wealth Rollercoaster

Hat tip to anonymous at 5:21pm. How do like the front page of the Edmonton Sun today? I dare say, it will be a cold day you-know-where before the local media puts a title like this on their front page!

The whole article can be found here. Average sale price in Calgary continues to drop as well.

Remember buddy here who bought two condos at Bear Mountain last fall? Unless he is independently wealthy, how long before him, and the tens of dozens of other Albertans, Americans, Irish, whoever, that bought condos out here as investments, start to sell off their properties because their artificial wealth back home has whithered away? How long before our active MLS listings hits 4000, 5000, 6000??? When will it start to skyrocket? And how high will it go?

Perhaps, an applicable analogy is to liken our current listings inventory to a rubber band. It continues to be stretched until finally, it's released, and away it goes!

Saturday, August 25, 2007

August 25 Week Ending Stats

Single family home listings on MLS.ca are up slightly this week. The largest increase saw 8 more homes listed in the price range of $300k to $400k. There are 11 fewer homes listed in the $400k to $500k range.

Year over year, MLS.ca listings of 2 bedroom condos and 3 bedroom SFH are down significantly from last year. 3 bedroom townhomes listings have decreased since June, but are still up year over year.

Here's a good article to read in the New York Times regarding Countrywide Financial Corp. Housing Panic rants on about this company and it's CEO. I think it's justified. He has not bought a share in his own company since 1987! I'd bet on Countrywide going belly-up. Any guesses on what impact that would have on housing and real estate in Canada?

Year over year, MLS.ca listings of 2 bedroom condos and 3 bedroom SFH are down significantly from last year. 3 bedroom townhomes listings have decreased since June, but are still up year over year.

Here's a good article to read in the New York Times regarding Countrywide Financial Corp. Housing Panic rants on about this company and it's CEO. I think it's justified. He has not bought a share in his own company since 1987! I'd bet on Countrywide going belly-up. Any guesses on what impact that would have on housing and real estate in Canada?

Thursday, August 23, 2007

Writer's Block

Sorry folks. I haven't been posting or writing or much of anything lately. I've recently switched positions at work and have been coming home pretty beat. I've got a little case of writer's block and I feel a little real estated out.

I'm getting tired of the constant cheer leading of the local real estate market by the media. I can't comprehend how they can say, in the same breath, that the U.S. market is so up the creek, but here in Victoria, prices will NEVER go down!

I have been enjoying the stock market roller-coaster over the past couple weeks. I'd sure love to be able to drink coffee and watch CNBC all day. It's like watching a basketball game!

I'm also finding the Alberta market quite interesting. Inventory is through the roof in Edmonton (and Calgary). Calgary's Real Estate Board has a 30 day rolling average selling price. It's been going down the past couple weeks. It was over $500k (up to around $507k I believe), and currently sits at $491k. I wonder if Alberta's market will be a sign of things to come for us.

Please carry on with the great comments! Thanks!

I'm getting tired of the constant cheer leading of the local real estate market by the media. I can't comprehend how they can say, in the same breath, that the U.S. market is so up the creek, but here in Victoria, prices will NEVER go down!

I have been enjoying the stock market roller-coaster over the past couple weeks. I'd sure love to be able to drink coffee and watch CNBC all day. It's like watching a basketball game!

I'm also finding the Alberta market quite interesting. Inventory is through the roof in Edmonton (and Calgary). Calgary's Real Estate Board has a 30 day rolling average selling price. It's been going down the past couple weeks. It was over $500k (up to around $507k I believe), and currently sits at $491k. I wonder if Alberta's market will be a sign of things to come for us.

Please carry on with the great comments! Thanks!

Saturday, August 18, 2007

August 18 Week Ending Stats

The number of active listings of SFH in Greater Victoria continued to decline this week.

- There are 969 SFH currently listed on MLS.ca

- This is 34 less than last week.

- This is 207 fewer listings than our recent peak on June 23 (there were 1176 SFH listings that day)

Houses are either selling or people are delisting their homes. I believe that it is the former. Sold stickers continue to be plastered against realtor signs. The market below $600000 continues to be quite hot, while above $600000, not so hot. I don't have proof, but that's what it appears to be.

It's quite perplexing how inventory is decreasing at this time of the year. Late summer and heading into fall, inventory should be increasing. I think Vancouver is seeing the same happenings. Rob Chipman's inventory is down from the peak of 2 months ago as well.

Possible reasons - a run on the market since interest rates appear (or appeared) to be rising. Perhaps it's the ever increasing popularity of 40 year mortgages. Yet more moms and dads are helping their kids. Any other ideas?

I've added another blog link under "The Nationals" section at the side. Titled "Canadian Mortgage Trends", it looks to contain some good bits of information.

- There are 969 SFH currently listed on MLS.ca

- This is 34 less than last week.

- This is 207 fewer listings than our recent peak on June 23 (there were 1176 SFH listings that day)

Houses are either selling or people are delisting their homes. I believe that it is the former. Sold stickers continue to be plastered against realtor signs. The market below $600000 continues to be quite hot, while above $600000, not so hot. I don't have proof, but that's what it appears to be.

It's quite perplexing how inventory is decreasing at this time of the year. Late summer and heading into fall, inventory should be increasing. I think Vancouver is seeing the same happenings. Rob Chipman's inventory is down from the peak of 2 months ago as well.

Possible reasons - a run on the market since interest rates appear (or appeared) to be rising. Perhaps it's the ever increasing popularity of 40 year mortgages. Yet more moms and dads are helping their kids. Any other ideas?

I've added another blog link under "The Nationals" section at the side. Titled "Canadian Mortgage Trends", it looks to contain some good bits of information.

Wednesday, August 15, 2007

Condemnation

A couple of note worthy articles in today's TC.

Four Rental Buildings Condemned. The landlord refuses to perform any upkeep on the buildings, and voila! Let's tear down the buildings and do something different - build luxury condos!

Unbuilt Building Condemned. Well, not quite. The Wing condo project in Vic West continues to be an eyesore, yet the local community association doesn't appear to want to do anything about it. I don't get the statement from Diane Carr "... it's not the community's obligation to make up for a bad investment on the part of the investors. That's not our problem." Alright, then forget about offers from developers who want to do something with that mess, and enjoy your eyesore!

I think that Victoria is being overbuilt at this time, however, I would sooner have a building, that perhaps doesn't please everyone, than an eyesore empty concrete-laden lot. My $0.02.

Four Rental Buildings Condemned. The landlord refuses to perform any upkeep on the buildings, and voila! Let's tear down the buildings and do something different - build luxury condos!

Unbuilt Building Condemned. Well, not quite. The Wing condo project in Vic West continues to be an eyesore, yet the local community association doesn't appear to want to do anything about it. I don't get the statement from Diane Carr "... it's not the community's obligation to make up for a bad investment on the part of the investors. That's not our problem." Alright, then forget about offers from developers who want to do something with that mess, and enjoy your eyesore!

I think that Victoria is being overbuilt at this time, however, I would sooner have a building, that perhaps doesn't please everyone, than an eyesore empty concrete-laden lot. My $0.02.

Monday, August 13, 2007

What do you think?

A local developer has approached me with an idea of theirs and would like some feedback. I offered to post their idea, and ask your opinions of it. Here goes...

A new home has been built in the city - 2000 sq. ft., maple, granite, wired for home theatre, all the good stuff. Rent would be set at $2500 / month. After one year, the renter would have the option of using their rent paid during the year ($30000) as a down payment on the purchase of the home. The home has an asking price of $500k. If the renter provides an additional $30000 for the down payment, the developer will borrow the renter an additional $40000 (at a 9% interest rate) for down payment. Total down payment would then equal $100k. As this is 20% of the purchase price, the purchaser qualifies for a conventional mortgage.

What do you think?

A new home has been built in the city - 2000 sq. ft., maple, granite, wired for home theatre, all the good stuff. Rent would be set at $2500 / month. After one year, the renter would have the option of using their rent paid during the year ($30000) as a down payment on the purchase of the home. The home has an asking price of $500k. If the renter provides an additional $30000 for the down payment, the developer will borrow the renter an additional $40000 (at a 9% interest rate) for down payment. Total down payment would then equal $100k. As this is 20% of the purchase price, the purchaser qualifies for a conventional mortgage.

What do you think?

Thursday, August 9, 2007

July Housing Starts and June New Housing Price Index

CMHC has released July housing starts numbers for Vancouver Island and Victoria. For Victoria, July 2007 housing starts were more than double that of July 2006. Year-to-date, housing starts in Victoria are up 19% in 2007 over 2006.

B.C., as a whole, and nationally, housing starts are down.

Statistics Canada has released the New Housing Price Index for June. Victoria had the second lowest price increase from June 2006 to June 2007, at 0.5%. The lowest price increase belongs to Windsor, ON, at -2.3%.

Go figure. In Victoria, housing starts are up, and prices are stagnant. The rest of Canada is seeing price increases, yet housing starts have decreased. Supply and demand? Looks like it.

B.C., as a whole, and nationally, housing starts are down.

Statistics Canada has released the New Housing Price Index for June. Victoria had the second lowest price increase from June 2006 to June 2007, at 0.5%. The lowest price increase belongs to Windsor, ON, at -2.3%.

Go figure. In Victoria, housing starts are up, and prices are stagnant. The rest of Canada is seeing price increases, yet housing starts have decreased. Supply and demand? Looks like it.

Tuesday, August 7, 2007

Focus on SFH Sales

As I did for condos and townhomes, I've made a few graphs for SFH sales and median prices for Greater Victoria, Victoria, Langford and Saanich.

The number of sales of single family homes in Greater Victoria is higher this year than 2005 and 2006. Median sale price is increasing, and has not been negative year-over-year since 2005.

The City of Victoria has had high sales numbers the past couple of months. The median sale price is down from earlier this year. June's median sale price was negative year-over-year.

Langford has had an average number of SFH sales thus far this year. The median sale price is increasing.

Saanich home sales have been on a tear the past two months. Median sale price is consistently increasing at around 10% year-over-year.

All regions' year-over-year median price increases (%) have risen from late 2006 and early 2007. It's difficult to determine a definitive pattern due to our small market. There have been very few year-over-year monthly decreases since 2005.

I plan to have graphs for other municipalities in the future. Hopefully this provides a little food-for-thought.

The number of sales of single family homes in Greater Victoria is higher this year than 2005 and 2006. Median sale price is increasing, and has not been negative year-over-year since 2005.

The City of Victoria has had high sales numbers the past couple of months. The median sale price is down from earlier this year. June's median sale price was negative year-over-year.

Langford has had an average number of SFH sales thus far this year. The median sale price is increasing.

Saanich home sales have been on a tear the past two months. Median sale price is consistently increasing at around 10% year-over-year.

All regions' year-over-year median price increases (%) have risen from late 2006 and early 2007. It's difficult to determine a definitive pattern due to our small market. There have been very few year-over-year monthly decreases since 2005.

I plan to have graphs for other municipalities in the future. Hopefully this provides a little food-for-thought.

Subscribe to:

Posts (Atom)