Stats Canada has release the New Housing Price Index for August.

The price of a new home in Victoria rose 0.4% between August 2006 and August 2007. Of the cities surveyed, this was the third smallest increase. Windsor (-2.8%) and Charlottetown (0.2%) lead the way. Canada as a whole had an increase of 6.5%.

Thursday, October 11, 2007

Tuesday, October 9, 2007

September Housing Starts

CMHC has released the housing starts numbers for September. For Victoria, more starts than in August, less than September 2006, fewer year to date in 2007 than 2006. Canada-wide, it was big news.

A sizzling condominium market propelled Canadian housing starts in September to their highest level since 1978, a 19.6 percent monthly jump, which well exceeded analysts' expectations.

Perhaps I'm naive, but I don't quite get it. The housing market in the U.S. is officially in the tank. 50/50 chance of recession there. Good chance we follow. Our population growth isn't exactly setting land speed records. Is it just plain cool to have two or three properties under your belt? Are Canadians still speculating? Who's buying or going to buy all these properties???

A sizzling condominium market propelled Canadian housing starts in September to their highest level since 1978, a 19.6 percent monthly jump, which well exceeded analysts' expectations.

Perhaps I'm naive, but I don't quite get it. The housing market in the U.S. is officially in the tank. 50/50 chance of recession there. Good chance we follow. Our population growth isn't exactly setting land speed records. Is it just plain cool to have two or three properties under your belt? Are Canadians still speculating? Who's buying or going to buy all these properties???

Saturday, October 6, 2007

October 6 Week Ending Stats

MLS listings were up and down this week. There are 43 more condo listings today than there were last Saturday. I believe this is largely due to the release of units at the new Radius development. Kudos to them for listing on MLS. This will increase the month end inventory numbers, and thus give a truer picture of the number of homes that are for sale, unlike those condo developments that have hundreds of units for sale, but their inventory numbers are not taken into account by the VREB because they are not listed on MLS. Shame on them.

Single family home listings are down by 27 this week. Victoria is definitely not having the run-up in SFH inventory like cities in Alberta are. This leads me to think that SFH in Victoria are built for home-dwellers, not speculators. Otherwise, we should be seeing more of a rush to the exit, as evidenced in Alberta. Barring external forces, the SFH market should remain steady for a while to come. I wouldn't say the same for the condo market.

I meant to post this earlier in the week. There was an interesting article in Macleans regarding a possible coming recession, titled "Can you say recession?" Hat tip to whoever pointed it out to me - I wish I could remember. If you have the time, give it a read.

Single family home listings are down by 27 this week. Victoria is definitely not having the run-up in SFH inventory like cities in Alberta are. This leads me to think that SFH in Victoria are built for home-dwellers, not speculators. Otherwise, we should be seeing more of a rush to the exit, as evidenced in Alberta. Barring external forces, the SFH market should remain steady for a while to come. I wouldn't say the same for the condo market.

I meant to post this earlier in the week. There was an interesting article in Macleans regarding a possible coming recession, titled "Can you say recession?" Hat tip to whoever pointed it out to me - I wish I could remember. If you have the time, give it a read.

Monday, October 1, 2007

September Sales Numbers

I've now officially been forever priced out of the market!

Just kidding - that happened a long time ago!

Well, September numbers are out. My guesses were close. Total sales = 632. Total inventory = 3381 listings. Average prices up month over month in every category. Average prices up year over year everywhere. It's very reassuring that "There were 17 single family home sales of over $1 million and this had a significant impact on the overall average. Nearly a quarter of all single family homes sold for less than $425,000." Thank goodness for that!

Due to a shortness of time this evening, I'm gonna let the graphs do the talking.

Condo sales graph.

Townhome sales graph.

Single Family home sales graph.

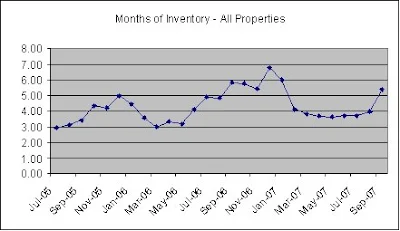

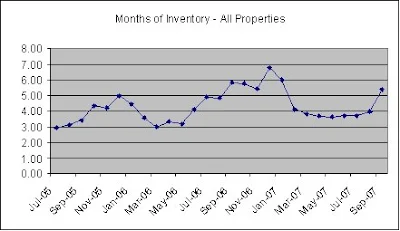

Months of inventory graph.

Oh yeah, 3 points for the Bears. It's the end of the 3rd quarter. Bulls 26 Bears 13.

Just kidding - that happened a long time ago!

Well, September numbers are out. My guesses were close. Total sales = 632. Total inventory = 3381 listings. Average prices up month over month in every category. Average prices up year over year everywhere. It's very reassuring that "There were 17 single family home sales of over $1 million and this had a significant impact on the overall average. Nearly a quarter of all single family homes sold for less than $425,000." Thank goodness for that!

Due to a shortness of time this evening, I'm gonna let the graphs do the talking.

Condo sales graph.

Townhome sales graph.

Single Family home sales graph.

Months of inventory graph.

Oh yeah, 3 points for the Bears. It's the end of the 3rd quarter. Bulls 26 Bears 13.

Saturday, September 29, 2007

September 29 Week Ending Stats

There are 3 more single family homes, 13 more condos, and 7 more townhomes listed on MLS.ca this Saturday over last.

Interestingly, for SFH, the only price ranges that have a decrease in listings today are those priced under $300k and over $700k.

Let's dissect the graph of the number of SFH listings in a price range as a percentage of the whole. Over the past year, the percentage of listings between $500k and $700k has been quite flat. The percentage of listings of homes priced over $700k is nearly a mirror image of the percentage of home priced between $300k - $400k and $400k - $500k. The gradual down slope of homes priced between $300k and $500k has levelled off this past month, which leads me to wonder whether external factors (credit crunch, American MSM, affordability) are having an effect on the lower priced homes. Sales plus delists are not exceeding new listings. Perhaps this is the start of things.

Let's dissect the graph of the number of SFH listings in a price range as a percentage of the whole. Over the past year, the percentage of listings between $500k and $700k has been quite flat. The percentage of listings of homes priced over $700k is nearly a mirror image of the percentage of home priced between $300k - $400k and $400k - $500k. The gradual down slope of homes priced between $300k and $500k has levelled off this past month, which leads me to wonder whether external factors (credit crunch, American MSM, affordability) are having an effect on the lower priced homes. Sales plus delists are not exceeding new listings. Perhaps this is the start of things.

Case and point - a friend was pondering whether to get into the market. About three weeks ago, her realtor pointed out MLS#235514. The house was priced at $399000. In today's hot market, the house was going to sell that weekend. It's three weeks later, the house has not sold, and has had two price reductions, with it now sitting at $379000. How hot is this market? It's definitely cooling.

The Victoria Real Estate Board's September numbers should come out early next week. They should be interesting, but I'm not losing sleep over them. I'm guessing a decrease in SFH average price, an increase in condo and townhome average price. Listings will be up slightly to just over 3400, sales will be between 750 and 800, well above last year. What's your guess?

Interestingly, for SFH, the only price ranges that have a decrease in listings today are those priced under $300k and over $700k.

Let's dissect the graph of the number of SFH listings in a price range as a percentage of the whole. Over the past year, the percentage of listings between $500k and $700k has been quite flat. The percentage of listings of homes priced over $700k is nearly a mirror image of the percentage of home priced between $300k - $400k and $400k - $500k. The gradual down slope of homes priced between $300k and $500k has levelled off this past month, which leads me to wonder whether external factors (credit crunch, American MSM, affordability) are having an effect on the lower priced homes. Sales plus delists are not exceeding new listings. Perhaps this is the start of things.

Let's dissect the graph of the number of SFH listings in a price range as a percentage of the whole. Over the past year, the percentage of listings between $500k and $700k has been quite flat. The percentage of listings of homes priced over $700k is nearly a mirror image of the percentage of home priced between $300k - $400k and $400k - $500k. The gradual down slope of homes priced between $300k and $500k has levelled off this past month, which leads me to wonder whether external factors (credit crunch, American MSM, affordability) are having an effect on the lower priced homes. Sales plus delists are not exceeding new listings. Perhaps this is the start of things.Case and point - a friend was pondering whether to get into the market. About three weeks ago, her realtor pointed out MLS#235514. The house was priced at $399000. In today's hot market, the house was going to sell that weekend. It's three weeks later, the house has not sold, and has had two price reductions, with it now sitting at $379000. How hot is this market? It's definitely cooling.

The Victoria Real Estate Board's September numbers should come out early next week. They should be interesting, but I'm not losing sleep over them. I'm guessing a decrease in SFH average price, an increase in condo and townhome average price. Listings will be up slightly to just over 3400, sales will be between 750 and 800, well above last year. What's your guess?

Thursday, September 27, 2007

CMHC "Housing Now" Report for August

CMHC has released their "Housing Now" report for August for Victoria.

Highlights include

- 70.6% decrease in starts between August 2006 and August 2007.

- 2% decrease in starts year to date from 2006.

- 31.6% increase in units under construction between August 2006 and August 2007.

- Langford (pop. 22500) has 799 units under construction.

- Saanich (pop. 108000) has 536 units under construction.

- Oak Bay has 15 units under construction.

Those last three points aren't really highlights, I just found them to be interesting.

CMHC's average selling price for SFH dropped for the second straight month. The difference between CMHC's average price, which doesn't include waterfront, acreage, duplex, and manufactured home sales, and VREB's average price is very evident for August. The sale of a $5million home certainly skews the average. That's why I believe that median sales price is a better indicator.

Highlights include

- 70.6% decrease in starts between August 2006 and August 2007.

- 2% decrease in starts year to date from 2006.

- 31.6% increase in units under construction between August 2006 and August 2007.

- Langford (pop. 22500) has 799 units under construction.

- Saanich (pop. 108000) has 536 units under construction.

- Oak Bay has 15 units under construction.

Those last three points aren't really highlights, I just found them to be interesting.

CMHC's average selling price for SFH dropped for the second straight month. The difference between CMHC's average price, which doesn't include waterfront, acreage, duplex, and manufactured home sales, and VREB's average price is very evident for August. The sale of a $5million home certainly skews the average. That's why I believe that median sales price is a better indicator.

Sunday, September 23, 2007

September 22 Week Ending Stats

Tuesday, September 18, 2007

Big Rate Cut

As everyone has heard, the U.S. Federal Reserve cut the overnight lending rate by 50 basis points, or 0.5%. The experts were somewhat surprised. I am surprised that they were surprised. Yet, their response was exactly what I had heard it would be, if there was a cut of that size. The experts are afraid of what lies ahead.

What does lie ahead? What does it bring for me and my family, the city and province I live in, and for Canada?

A person could theorize and hypothesize until the cows come home. Even with that, they could still not get it right. If any one person could predict what was going to happen, well, they'd be very rich. Perhaps that is why statements from Warren Buffet and the likes are well heeded.

I have no idea. That's why I started this blog. But here's what I could possibly see. Rate cut in the U.S. - U.S. dollar drops - CAN$ rises - CAN exports continue to fall (except oil) - things slow even further in export reliant regions of CAN - CAN economy slows - rate cuts in CAN - housing market????

I'm no expert. What do you think? Where will B.C.'s and Canada's economies be in 1 year from now? 5 years from now?

What does lie ahead? What does it bring for me and my family, the city and province I live in, and for Canada?

A person could theorize and hypothesize until the cows come home. Even with that, they could still not get it right. If any one person could predict what was going to happen, well, they'd be very rich. Perhaps that is why statements from Warren Buffet and the likes are well heeded.

I have no idea. That's why I started this blog. But here's what I could possibly see. Rate cut in the U.S. - U.S. dollar drops - CAN$ rises - CAN exports continue to fall (except oil) - things slow even further in export reliant regions of CAN - CAN economy slows - rate cuts in CAN - housing market????

I'm no expert. What do you think? Where will B.C.'s and Canada's economies be in 1 year from now? 5 years from now?

Sunday, September 16, 2007

September 15 Week Ending Stats

The number of listings available on MLS.ca for Greater Victoria increased this past week. This includes

- 39 more condos.

- 3 more townhomes.

- 32 more SFH.

The largest increase in listings of SFH by price breakdown was in the $300k to $400k range. There are 10 more houses on MLS.ca in this price range this week.

Even with the increase in SFH listings, the pie chart breakdown is still very top heavy.

I think the increase in listings this past week is the beginning of the traditional run-up of inventory in the fall months. With the associated decrease in sales during fall, the months supply of inventory will increase. The September sales numbers will be very interesting.

- 39 more condos.

- 3 more townhomes.

- 32 more SFH.

The largest increase in listings of SFH by price breakdown was in the $300k to $400k range. There are 10 more houses on MLS.ca in this price range this week.

Even with the increase in SFH listings, the pie chart breakdown is still very top heavy.

I think the increase in listings this past week is the beginning of the traditional run-up of inventory in the fall months. With the associated decrease in sales during fall, the months supply of inventory will increase. The September sales numbers will be very interesting.

Friday, September 14, 2007

Slow Growth, Cool Market

Front page of today's TC had articles regarding Victoria's economic growth and real estate market. HouseHuntVictoria has insight on the related article in The Globe and Mail.

Victoria's economic growth to slow - rather significantly as well. 2006 had growth pegged at 3.7%. 2007 is forecasted at 2.8%.

Real estate market expected to cool over the long term - Victoria's current market is 10% above trend, according to Scotia Economics' Adrienne Warren. Quote from Cameron Muir "... it is reasonable to expect that when this current cycle is over that home prices will moderate for a while in order to give household incomes a chance to catch up with the pricing regime."

Does this mean that I may not be priced out forever?! Is today maybe not the best time to buy? Perhaps the future is better than the present for getting into the market. I'm surprised by Mr. Muir's statement. He may be starting to see the light.

Victoria's economic growth to slow - rather significantly as well. 2006 had growth pegged at 3.7%. 2007 is forecasted at 2.8%.

Real estate market expected to cool over the long term - Victoria's current market is 10% above trend, according to Scotia Economics' Adrienne Warren. Quote from Cameron Muir "... it is reasonable to expect that when this current cycle is over that home prices will moderate for a while in order to give household incomes a chance to catch up with the pricing regime."

Does this mean that I may not be priced out forever?! Is today maybe not the best time to buy? Perhaps the future is better than the present for getting into the market. I'm surprised by Mr. Muir's statement. He may be starting to see the light.

Subscribe to:

Comments (Atom)